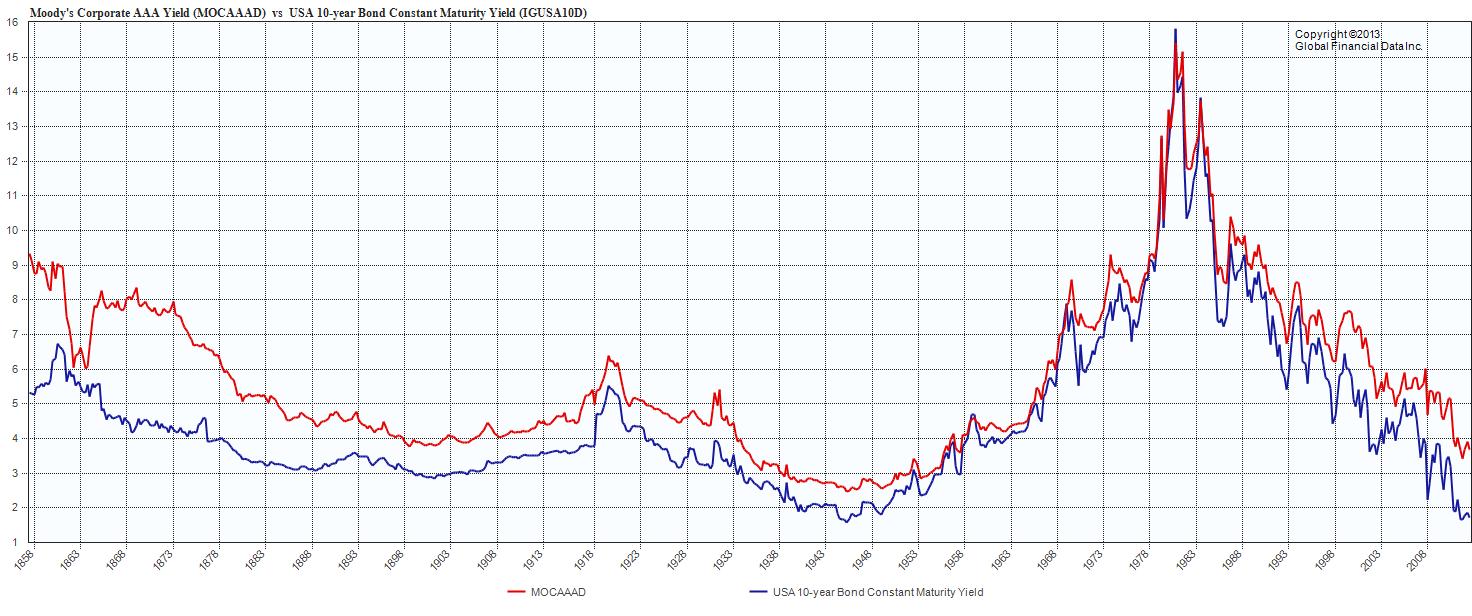

Moody’s Corporate AAA bond yields vs US 10yr Constant Maturity Yield to 1857

There is a tendency to look at the S&P500 Dividend Yields vs US 10 year, but in many ways, that is a less than ideal comparison. Corporate Bonds are more of an apple to apple comparison.

Note that there is an almost 200 bps spread over the US 10yr — nearly double the dividend yield of the S&P500.

We keep talking about how the “Great Rotation” into equities from bonds has not yet happened, but folks looking for yield may wish to pay more attention to AAA rated corporates.

Source:

Ralph M Dillon (rdillon@globalfinancialdata.com)

www.globalfinancialdata.com

What's been said:

Discussions found on the web: