The ongoing corruption of Murdoch-run WSJ continues apace — If you just skimmed the headlines, you might have a very different takeaway than what the articles authors intended.

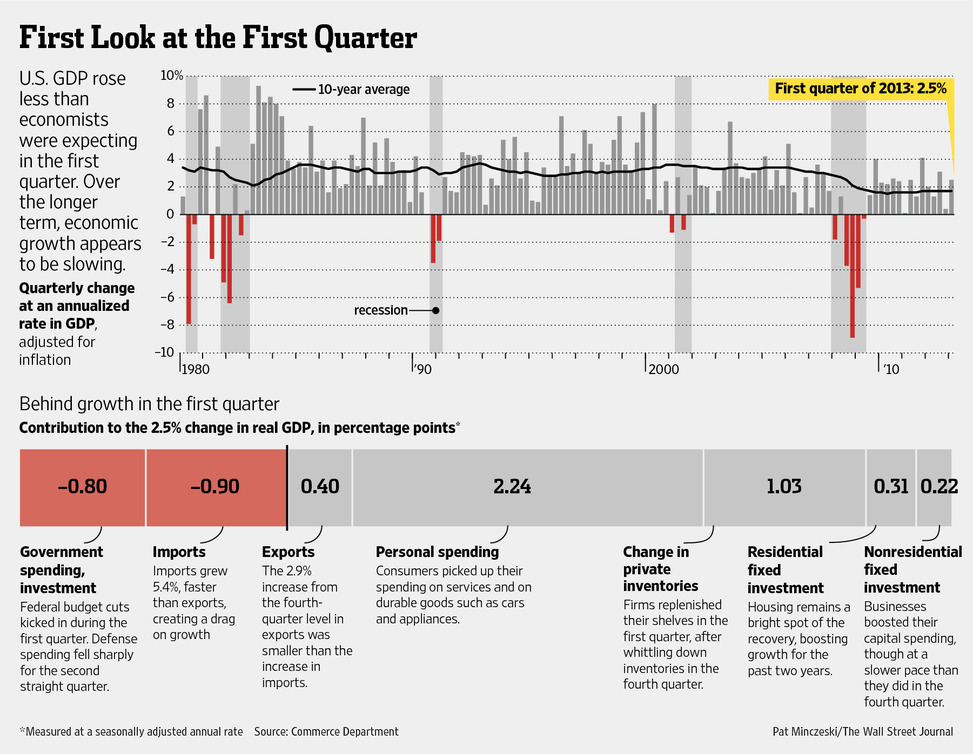

I doubt anyone’s response to a headline that stated “Economic Growth Stays Soft” would be “I guess the economy is expanding at an annualized 2.5% pace. (as the content of the article makes clear). Indeed, stays soft when the prior quarter was flat is not just silly, its mathematically wrong when you go from a 0.1% GD to a 2.5% GDP (both annualized).

The headline, on the other hand, is pure Murdoch propaganda. When are they going to spin the WSJ out away from the Murdoch journalistic wrecking crew?

As a comparison, Bloomberg shows what objectivity looks like: Growth in U.S. Trails Forecasts as Defense Spending Falls

One last thought: WSJ blogs such as Real Time Economics do not seem to have the same editorial interference as the paper does. Hence, we see actual journalism, nuanced and complex, free of Murdoch’s political agenda: A perspective looking at various economic sectors such as this Five Takeaways From GDP Report, a nuanced, objective view like this GDP to Get Bigger, Not Necessarily Faster and lastly, a quirky, oddity such as GDP Revisions Aim to Account for Value of Art.

Some people think Blogs will replace MSM in terms of objective, informative news in the future. By all appearances, it looks like that has already happened at Murdoch’s flagship WSJ.

Source:

Economic Growth Stays Soft

SUDEEP REDDY

WSJ, April 26, 2013

http://online.wsj.com/article/SB10001424127887323789704578446513668963282.html

What's been said:

Discussions found on the web: