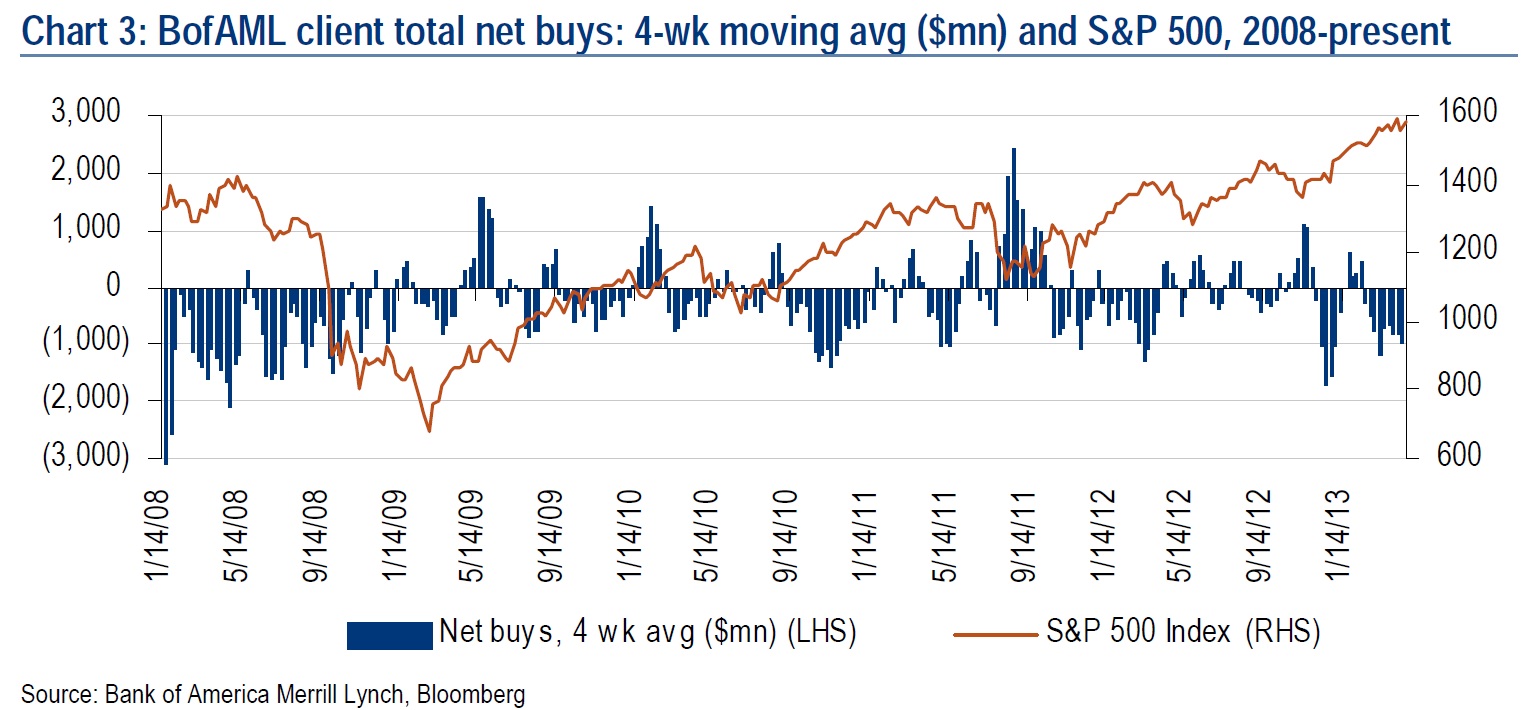

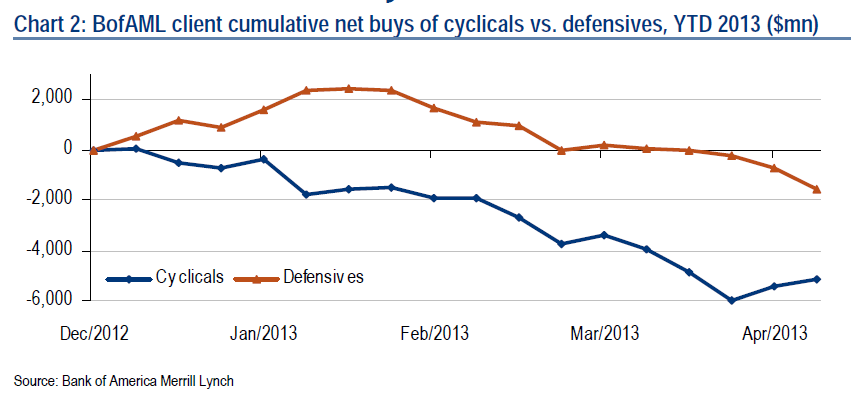

There are many different ways to measure investor confidence and market sentiment.BoA Merrill Lynch looks at their client flows relative to the market. Some of this is instructive:

On the one hand, private clients were net sellers in four of the last five weeks. However, as the chart shows above, there is a possible rotation starting away from Defensives and towards Cyclicals. That move might suggest that sentiment is improving.

One caveat: It is easy to cherry pick what you want when it comes to investor sentiment. This has a bullish color to it, but there are lots of other bearish readings as well.

BofA Merrill Lynch’s Equity Client Flow Trends: Cyclicals vs. Defensives

Source:

BofA Merrill Lynch’s Equity Client Flow Trends

Savita Subramanian, Dan Suzuki, Alex Makedon, Jill Carey

Equity and Quant Strategy

Bank of America Merrill Lynch, April 30, 2013

What's been said:

Discussions found on the web: