My afternoon train reads:

• Why the Stock Market Goes Up As Jobs Go Nowhere (Financial Sense)

• This is the VaR that slipped through the cracks (FT Alphaville)

• Why China’s economy might topple (FT.com) see also China’s Post-crisis Borrowing Boom Comes Home to Roost for Local Authorities (Institutional Investor)

• Savings Glut meets the Great Recession (Fatas and Mihov)

• Traders Welcome Fed’s Minutes Snafu (WSJ) see also Helicopter QE will never be reversed (Telegraph)

• Handicapping Labor Data (Tim Duy’s Fed Watch)

• The New Central America Second Home Buyers (World Property Channel) see also U.S. Land Gets More Expensive (WSJ)

• How High Should Top Income Tax Rates Be? (Hint: Much Higher) (Fiscal Times)

• America’s Three Elections: One For The Rich, One For The Crazy, And One For Everyone Else (priceonomics)

• Wicked cool new iPhone app: Status Board (Status Board)

What are you reading?

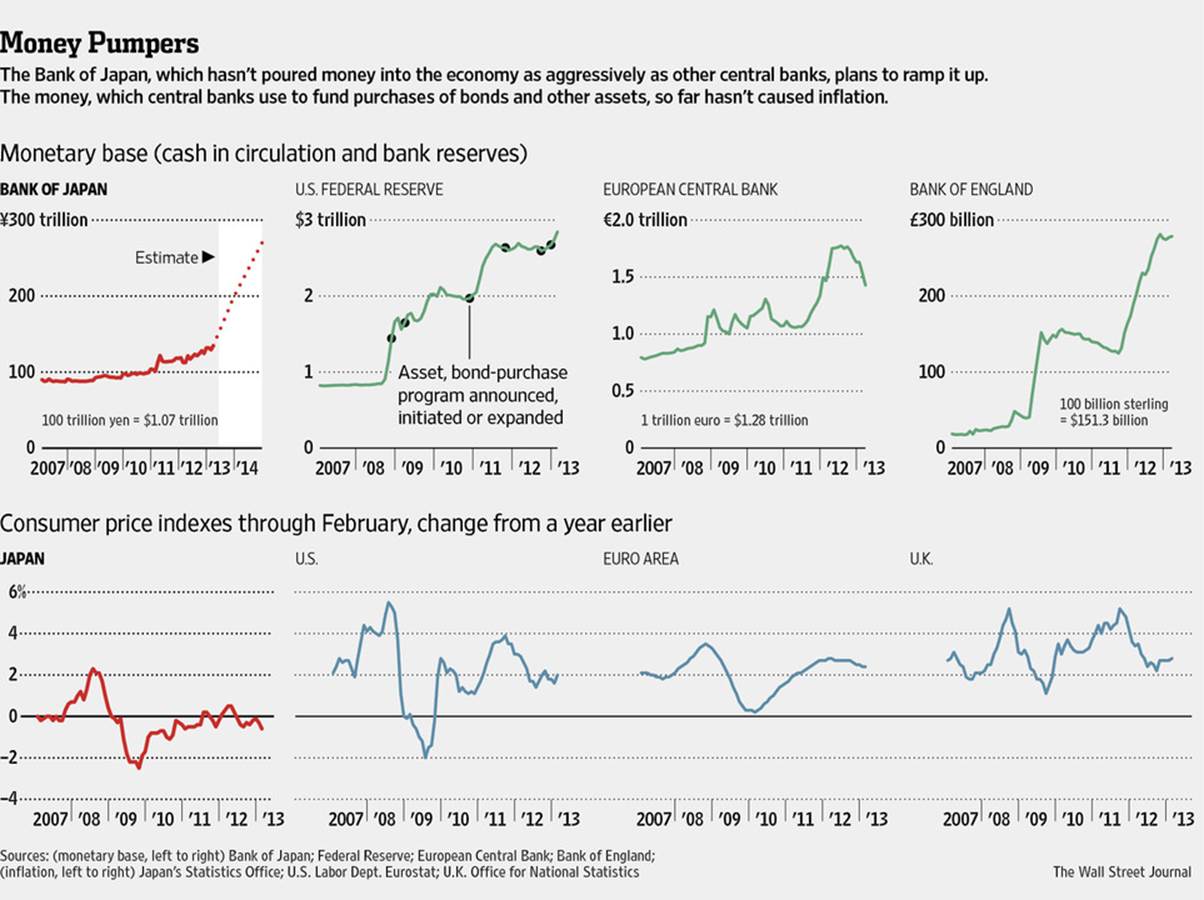

Money Spigot Opens Wider

Source: WSJ

What's been said:

Discussions found on the web: