Click to enlarge

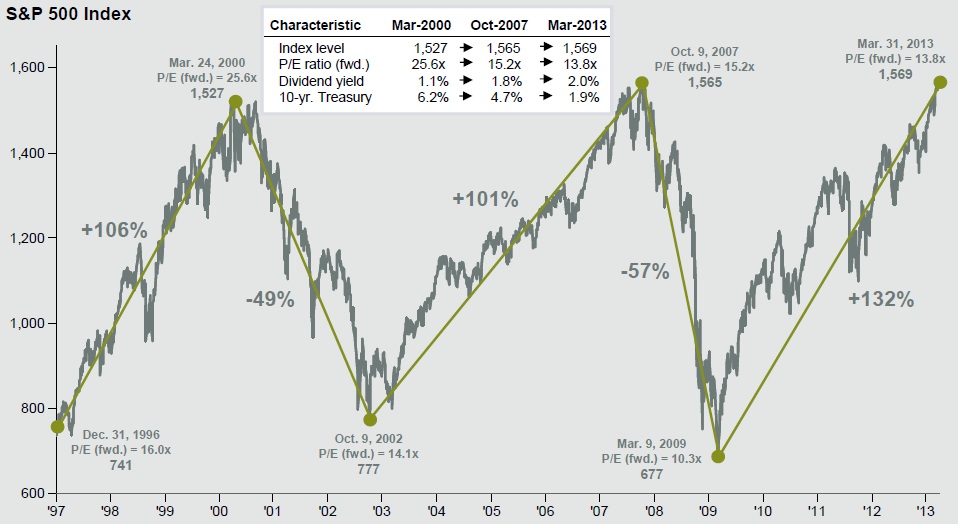

Source: Standard & Poor’s, First Call, Compustat, FactSet, March 31, 2013

Each quarter, J.P. Morgan Asset Management puts out a lovely guide to the markets. Its filled with all sorts of excellent and informative charts — its 70 pages long, and its free.

Check it out.

What's been said:

Discussions found on the web: