You probably heard the chatter over the past few quarters: “The Great Rotation” was about to unleash a new leg up in Equities. Bonds were going to be sold, equities purchased, and a new leg up was starting.

The story goes something like this: U.S. Treasury Bonds had enjoyed a 30 year bull market, and it was now coming to an end. Paul Volcker rebooted fixed income, taking rates to 20% to break inflation, and in the three decades since bonds have seen their prices inflate as rates normalized, then fell precariously low, then were driven to zero by QE. That cycle is over, we are told, as rates now have nowhere to go but up, and investors will soon become sensible and rotate into equities.

Except, of course, that it hasn’t.

Why? Perhaps we should consider an alternative explanation to the sector rotation story, which is rapidly being revealed as little more than wishful thinking.

The story that is not getting told nearly as much: The investment community noticed the success of Endowment funds (e.g., Yale’s David Swensen). The monkey-see-monkey-do community, ignoring valuations and prior gains, hired new consultants to shake it up. “Make us look like Yale” they pleaded to the mostly worthless community of consultants. No fools they, the overpaid consultants happily complied, and the next thing we know, these Whiffenpoof Wannabes are up to their eyeballs in private equity, hedge funds, structured products, real estate, and commodities/managed futures.

Gee, late-to-the-party investors in illiquid, pricey investments — who ever could have imagined that this was not going work out particularly well.

Time for a change: Fast forward a disastrous decade. As managers and consultants were replaced/fired, the new guys wanted to start unwinding the work of their priors. Since most of these alternative asset classes are illiquid, there is not a lot of wiggle room without severe haircuts (penalties for early withdrawal). What to do.

One of the few that is not are the Commodities/Managed futures bucket. My guess, based on prices and logic, is that these new managers are selling what they can — and that is commodities.

What do the charts (after jump) say?

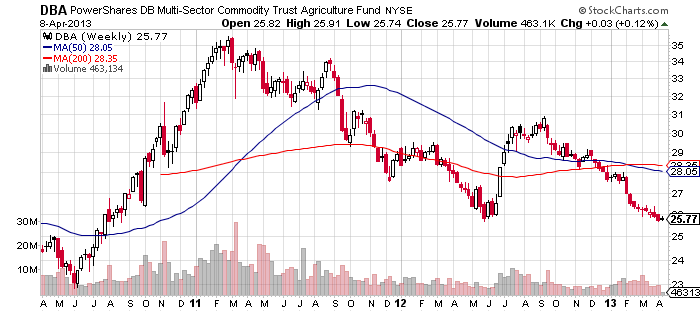

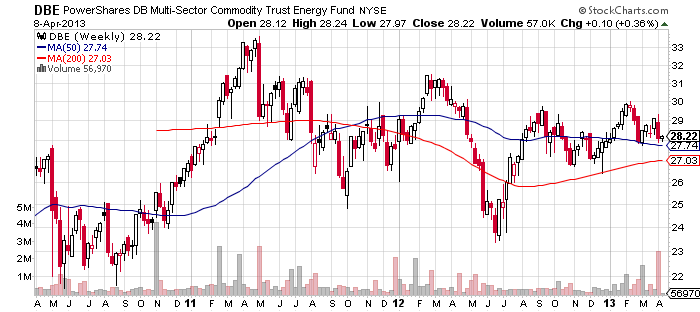

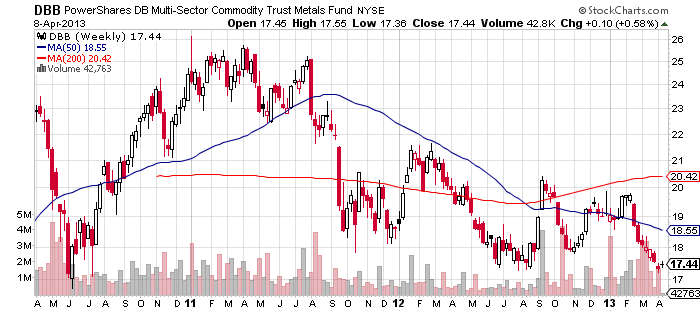

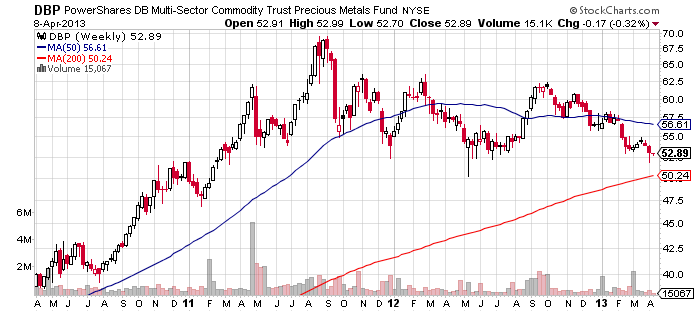

Gold and Silver flat for 2 years. Energy for even longer. Agricultural products back to 2010 prices. Industrial metals near 2010 lows.

Commodities started the 2000s so promising — what with rampant inflation and the dollar losing 41% of its value, have since gone nowhere. So the new guys are sellers, and the money is going into less esoteric, liquid assets.

That means traditional assets: Munis, Treasuries and Corporates for the safe money, stocks for their risk assets.

The great rotation is already underway. Just not the way the stock bulls have been hoping for.

Agricultural Prices

Energy Products

Industrial metals

Precious metals

What's been said:

Discussions found on the web: