Absolutely nothing:

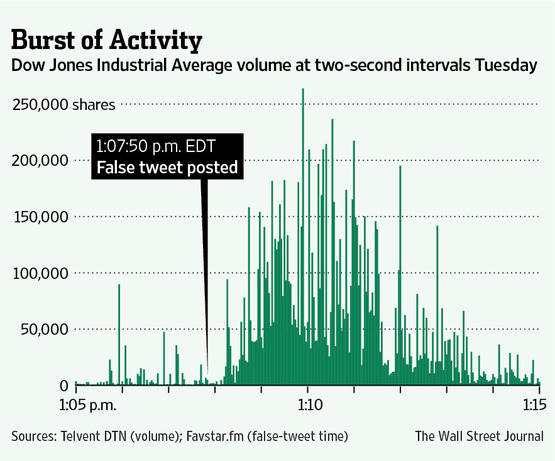

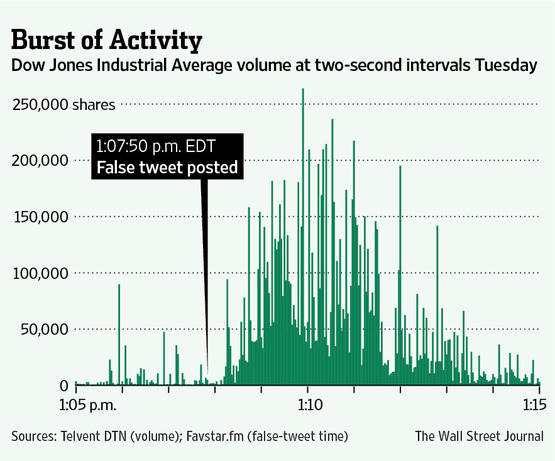

Source: Nanex

Source: WSJ

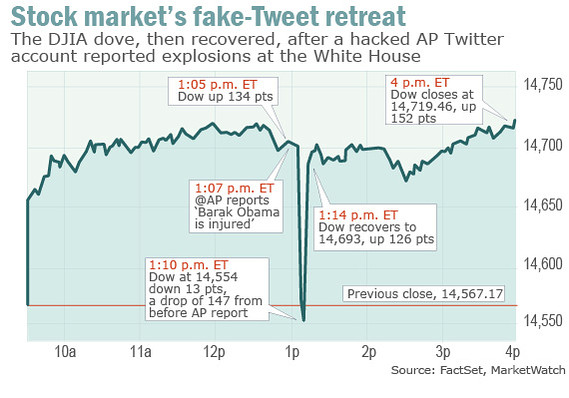

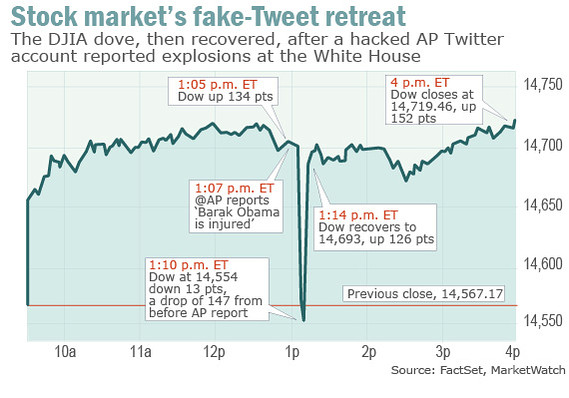

Stock Market’s Fake-Tweet Retreat

Source: MarketWatch

video after the jump

HFT (Huh!) Good Gawd Y’all What is it Good For? Absolutely Nothing Say it again! (Huh!) Listen to me. Hey!

Absolutely nothing:

Source: Nanex

Source: WSJ

Stock Market’s Fake-Tweet Retreat

Source: MarketWatch

video after the jump

HFT (Huh!) Good Gawd Y’all What is it Good For? Absolutely Nothing Say it again! (Huh!) Listen to me. Hey!

Get subscriber-only insights and news delivered by Barry every two weeks.

What's been said:

Discussions found on the web: