Click to enlarge

Source: Merrill Lynch

Here is another one of those things I find perplexing:

I keep hearing that healthcare, utilities and consumer staples are doing well — and that this rotation is usually caused by fear of an economic slowdown.

But what if its something else? Might healthcare be part of a secular move caused by the aging of the baby boomers? Utilities and Staples both have high dividends — might these be an alternative to 10 year Treasuries yielding 1.73 today?

To those people expecting a recession, how can we explain the Consumer Discretionary sector hitting highs?

I don’t have the answers, but my curiosity leads me to these questions.

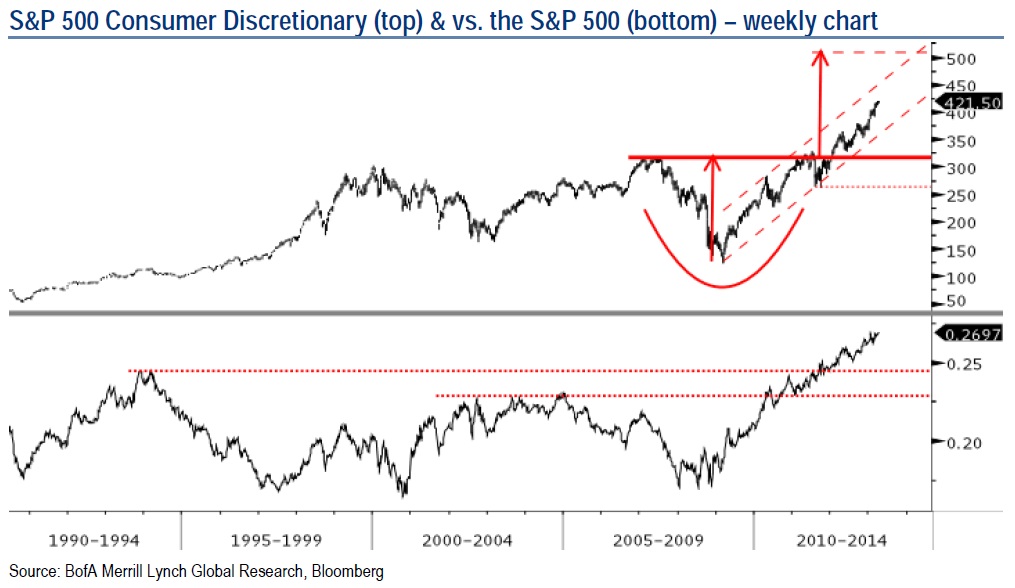

And the chart above, via MER — showing that Consumer Discretionary sector is in a “secular bull market on both an absolute and relative price basis. The big breakouts from early 2012 remain intact and the sector achieved new all-time absolute and relative price highs yesterday.”

Merrill notes that “this is a bullish back-drop for the sector and for the US equity market longer-term.”

Source:

New absolute & relative highs for Consumer Discretionary

Stephen Suttmeier, Jue Xiong

Merrill Lynch, April 09, 2013

What's been said:

Discussions found on the web: