Matt Trivisonno writes:

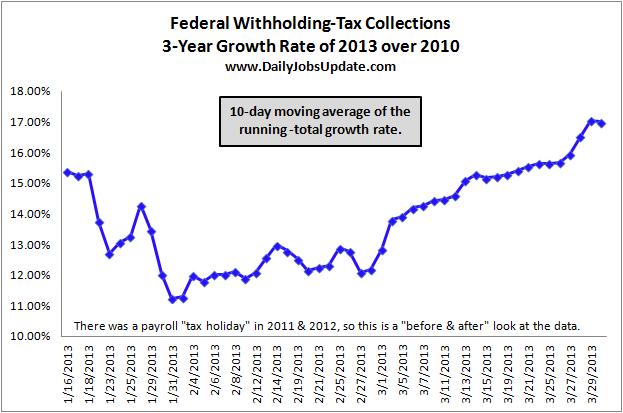

“At this point of the year in 2010, the Treasury Department had collected $459.6 billion in withholding taxes from the paychecks of American workers. Now in 2013, the amount stands at $545.9 billion – up $86.3 billion or 18.8%. (We compare to 2010 because there was a payroll “tax holiday” in 2011 & 2012).

An 18.8% growth rate over three years is pretty respectable in an era of scant wage inflation. Even more impressive is the recent trajectory of the growth rate. In the chart above (“3-Year-Growth”) you can see that the rate surged all throughout March. The chart plots the 10-day moving average of the growth-rate to give us a look at the second-derivative. As you can see it was “up, up, and away” during March.

So, the odds of a disappointing jobs report on Friday seem very low.

If a weak number is reported, the odds favor it will likely be revised upward in the future. The consensus forecast among economists is for only +193,000 jobs, which is substantially lower than the 236,000 added in February.

That forecast appears to be excessively gloomy in light of the withholding-tax data, perhaps setting the stage for another upside surprise. On the other hand, the stock market was strong during March, so perhaps it has already priced in the news.

Source: Daily Jobs Update

What's been said:

Discussions found on the web: