GLD was briefly the world’s biggest exchange-traded fund. In August 2011, GLD had assets of more than $77 billion, surpassing SPY (SPDR S&P 500 ETF) for a short time. The SPDR Gold Trust’s market capitalization rose to $76.7 billion — gold briefly topped $1,880/ounce. At the same time, SPY’s “capitalization” was ~$74.4 billion.

I missed this detail in real time (I caught the Bond version in 2003). With the benefit of hindsight, its easy to say this was a contrarian signal. Not that you should short GLD, although that surely was a wonderful trade. But rather, that SPY was attractive, as this was a sign of extreme dislike for equities.

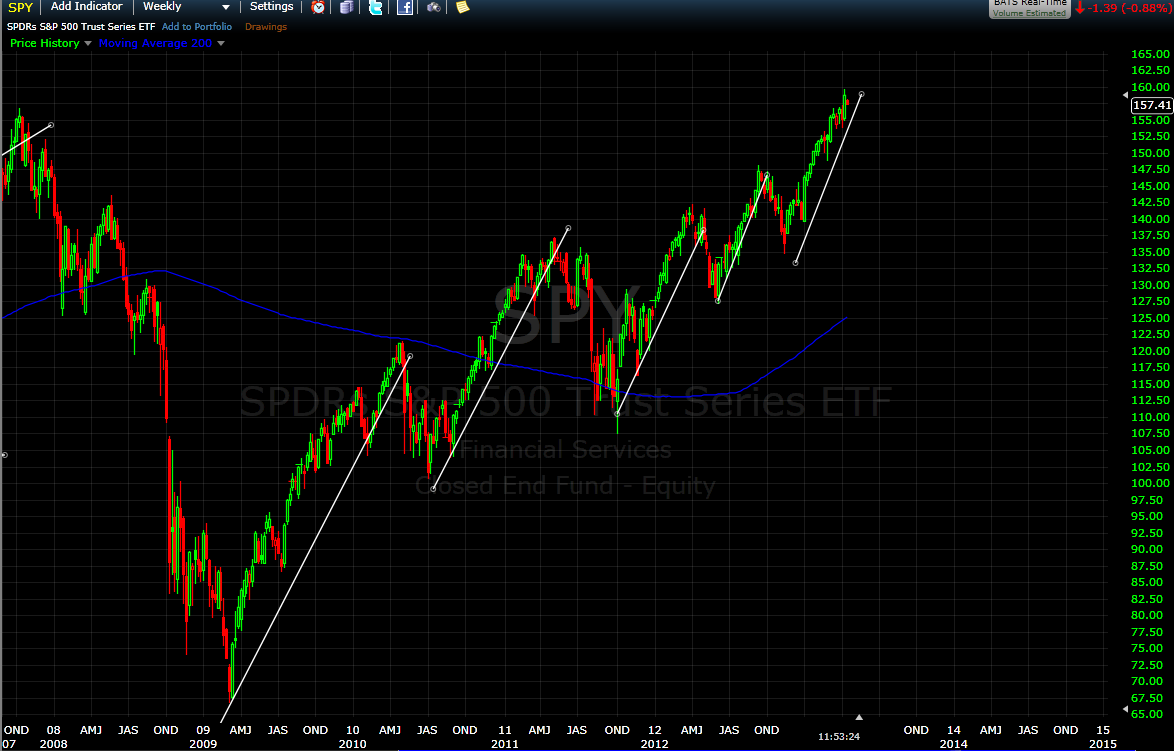

Have a look at the SPY chart and GLD (and Apple as well). click charts to enlarge them

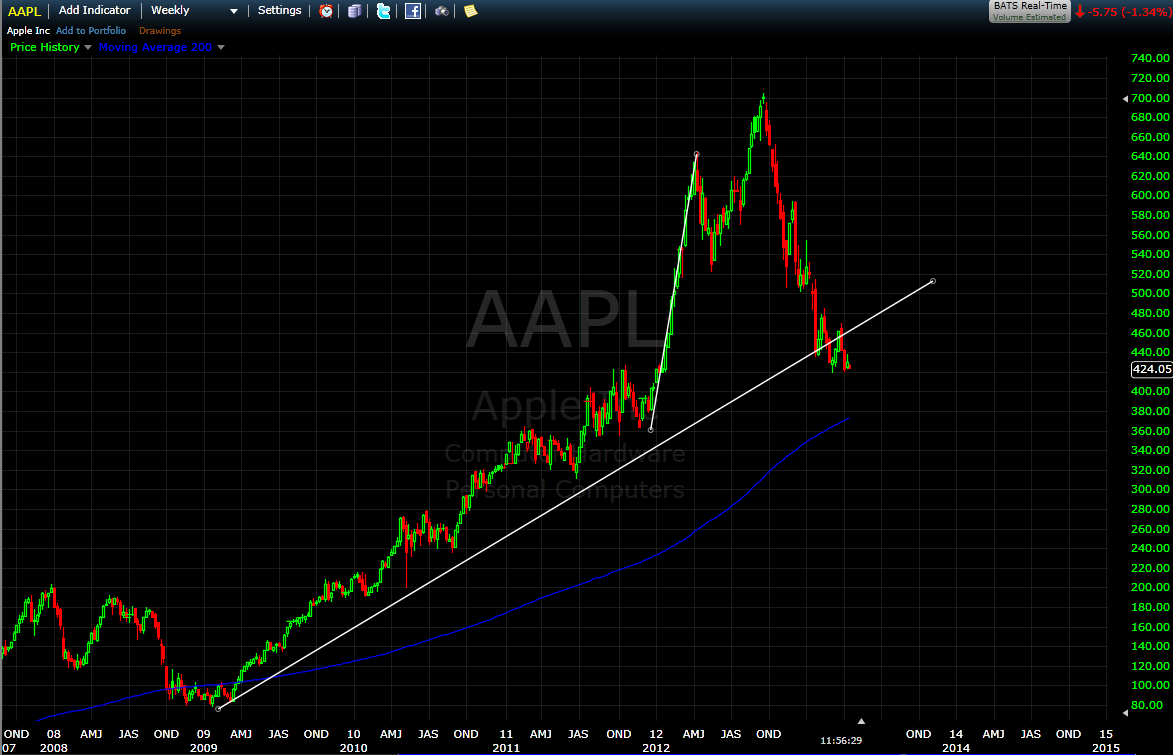

And for a little comparison, here is Apple — GLD looks somewhat similar . . .

What's been said:

Discussions found on the web: