My morning reads:

• Market bears still waiting for pullback (CNNMoney) but see It’s not just stocks; everything is overvalued (MarketWatch)

• Welcome to Saudi America (FT Alphaville)

• Fees of Fees don’t sound like a great deal for the investors: 2 & 20% + 1.5% yearly fee + (one time) 3% placement charge (NYT) see also The Things You See at a Las Vegas Hedge Fund Confab (NY Mag)

• Fidelity vs. Vanguard: Which is best? (MarketWatch)

• Foreclosure Filings in US Hit Six-Year Low (World Property Channel) see also Challenge to Dogma on Owning a Home (NYT)

• Paulson Bid to Resurrect Reputation Hurt by Gold Gone Bad (Bloomberg)

• Our Swiftly Melting Deficit, Or How the U.S. is Killing It (Daily Beast) see also Why Republicans Really Love Budget Deficits (The Fiscal Times)

• More money, more self-reported satisfaction, but not more happiness… (FT Alphaville)

• Turn Bad Stress Into Good (WSJ)

• Sexiest Women and Hottest Celebrities (Maxim)

What are you reading?

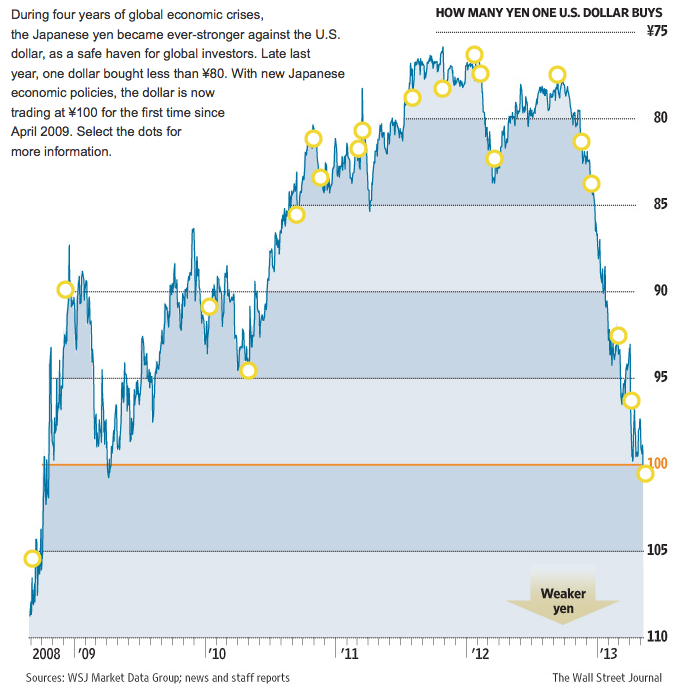

Yen’s Fall Trickles Through Japanese Economy

Source: WSJ

What's been said:

Discussions found on the web: