It does not look like the best weather this weekend, so I expect to be around to keep you entertained:

• The Smart Money Is Still Bullish (Barron’s)

• Notes from the PIMCO Investment Summit with Mohamed El-Erian (The Reformed Broker) Is this the dumb money?

• With ‘Abenomics,’ Japan catches a sense of revival (WaPo) see also Japan the Model: We are in economic terms, all Japanese (NYT)

• Gold Traders Most Bullish in a Month After Bernanke (Bloomberg)

• The Rules, Part XXXVIII (The Aleph Blog)

• Why pension funds are eating your 401(k)’s lunch (Reuters)

• Tax Two-fer:

…..-In Tax Overhaul Debate, Large vs. Small Companies (NYT)

…..-The Corrosive Effect of Apple’s Tax Avoidance (NYT)

• Four Reasons Housing Recovery Isn’t Yet Boosting Economy (Real Time Economics)

• Android’s Market Share Is Literally A Joke (Tech.pinions)

• Photos: Tornadoes wreak havoc in US (Boston.com’s Big Picture)

What are you reading?

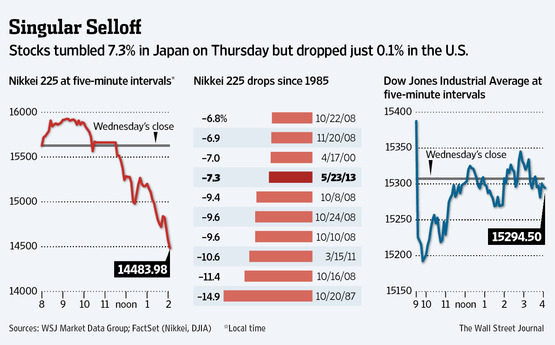

World Shakes Off Nikkei’s 7.3% Plunge

Source: WSJ

What's been said:

Discussions found on the web: