My morning end of week, end of month reads:

• Keynes Answers His Critics (Forbes)

• Why TV Has Resisted Disruption (stratechery) see also Fan TV revealed: is this the set-top box we’ve been waiting for? (The Verge)

• The New R&D: Repurchases and Dividends (The Reformed Broker)

• And the Winner Is … the Euro? (Moneybeat) see also Emerging-Market FX Gets Ugly. Very Ugly. (Moneybeat)

• Paul Volcker on good governance, Abenomics and why he won’t serve on any more commissions (Wonkblog)

• Dan Gross: Banks Are Thriving Despite Regulations Thanks to Economic Growth (The Daily Beast)

• The Fed’s been keeping the economy afloat. That’s the problem. (Wonkblog) see also Households Still Haven’t Rebuilt Lost Wealth (Real Time Economics)

• Ex-Microsoft manager plans to create first U.S. marijuana brand (Reuters)

• Architectural Heights of Fancy (NYT)

• Google Gets Ready for Its Close-Up (WSJ)

What are you reading?

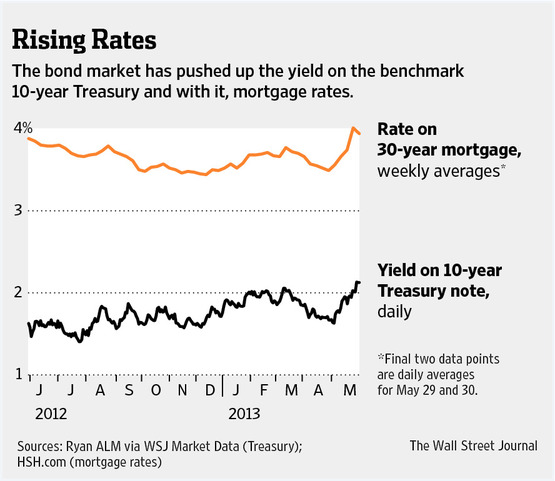

Swoon in Bonds Puts Eye on Fed

Source: WSJ

What's been said:

Discussions found on the web: