My afternoon train reads:

• How Van Halen Explains the U.S. Government (Bloomberg)

• Optimism as a Default Setting (The Reformed Broker) see also Motivated Reasoning (Above the Market)

• Clayton Christensen Wants to Transform Capitalism (Wired)

• China’s credit-to-GDP ratio (and why it matters) (FT Alphaville)

• Labor pains continue despite soaring profits (New York Post) see also As Jobs Lag, Fed Is Viewed as Unlikely to Do More (NYT)

• WTF? A new GOP bill would prevent the government from collecting economic data (Wonkblog)

• Android’s Leaky Bucket: Loyalty Gives Apple the Edge Over Time (All Things D) but see Apple’s Ive Seen Risking iOS 7 Delay on Software Overhaul (Bloomberg)

• The next generation of Instapaper (Macro.org)

• Six Months After Sandy (WSJ)

• Alfred Hitchcock and His Blondes (Classic Driver)

What are you reading?

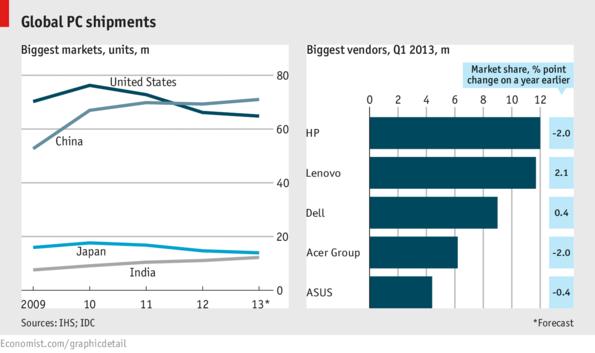

China Overtakes US to become World’s Biggest PC Market

Source: Economist

What's been said:

Discussions found on the web: