My morning reads:

• Hulbert: 3 things not to worry about right now (MarketWatch)

• Gold U. Takes It on the Chin (WSJ) see also Risk of vicious circle for gold as hedging returns (Telegraph)

• A Keynesian Victory, but Austerity Stands Firm (NYT)

• Of Course Apple Avoids Billions in Taxes—and It Should (Atlantic) but see The seven craziest findings in the US investigation of Apple’s tax avoidance practices (Quartz)

• Blowing Bubbles in Japan (WSJ)

• We are technically offshore! For U.S. Companies, Money ‘Offshore’ Means Manhattan (NYT)

• Hiaasen: IRS Went After Small Fish, But Let The Big Ones Get Away (National Memo)

• Are these Pakistani men behind Facebook’s teen spam empire? (Daily Dot)

• Vitamins That Cost Pennies a Day Seen Delaying Dementia (Bloomberg)

• XBOX One Revealed (Wired)

What are you reading?

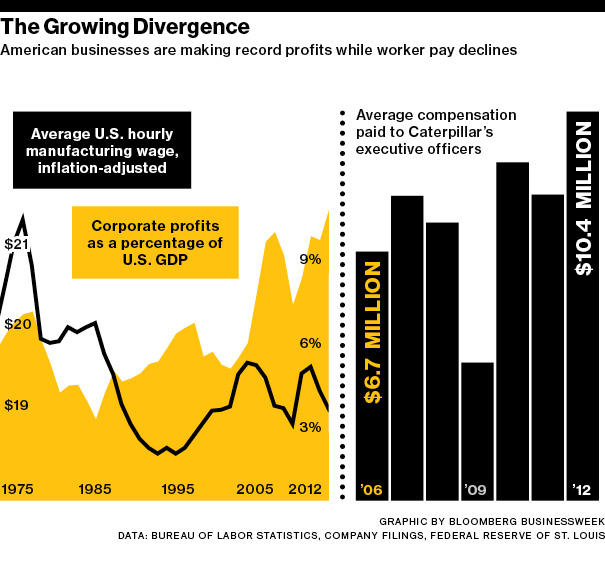

Caterpillar’s Doug Oberhelman: Manufacturing’s Mouthpiece

Source: Businessweek

What's been said:

Discussions found on the web: