My afternoon train reading:

• Boom or Bubble? (The New Yorker) but see Is This the Best Time for Investors? Don’t Bet On It. (WSJ)

• How Benjamin Graham Revolutionized Shareholder Activism (Echoes)

• Dear NYSE: Canceling Trades Destroys The Integrity of The Market (Kid Dynamite’s World)

• Telling the Truth on Fees, Warts and All (NYT) see also Making your financial adviser measure up (MarketWatch)

• Gross to Buffett Omens Disregarded as Sales Soar (Bloomberg)

• What’s Holding Back Hiring? (Real Time Economics)

• Wall Street Deregulation Advances Despite Warnings Vote Could ‘Haunt’ Congress (HuffPo)

• How much? Samsung swipes 95% of Android profits (Digital Trends)

• Tesla’s fight with America’s car dealers (CNN Money)

• 12 reasons X-Prize billionaires are cheapskates (MarketWatch)

What are you reading?

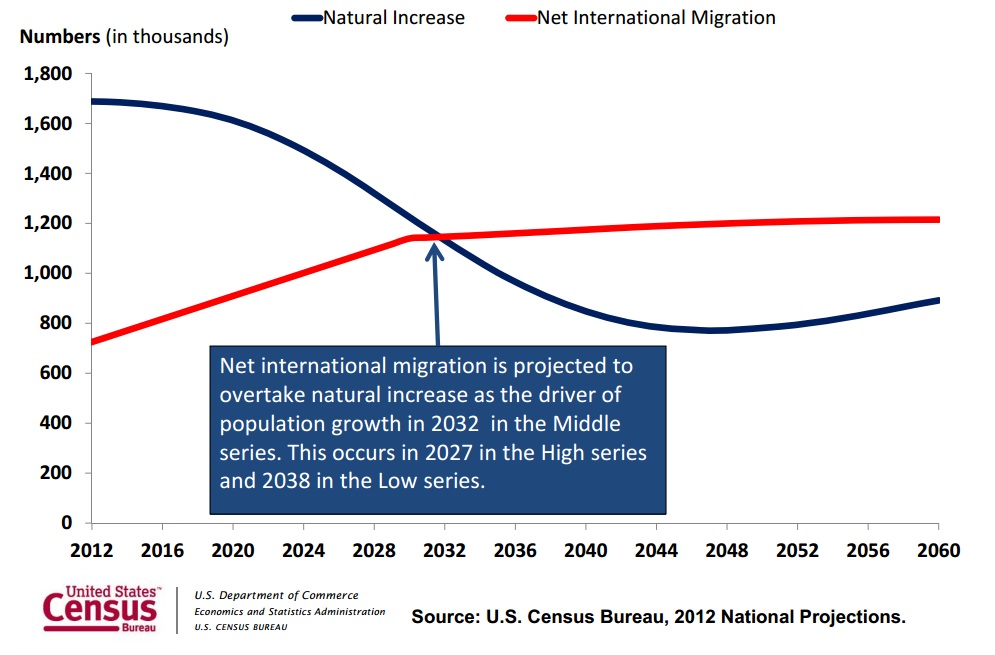

Where International Migration Passes Natural Population Increase (Births ‐Deaths): 2012 to 2060

Source: Census

What's been said:

Discussions found on the web: