My morning reads:

• More Forceful Fed Stands by Stimulus (NYT) see also Watch What the Fed Says and What the ECB Does (Barron’s)

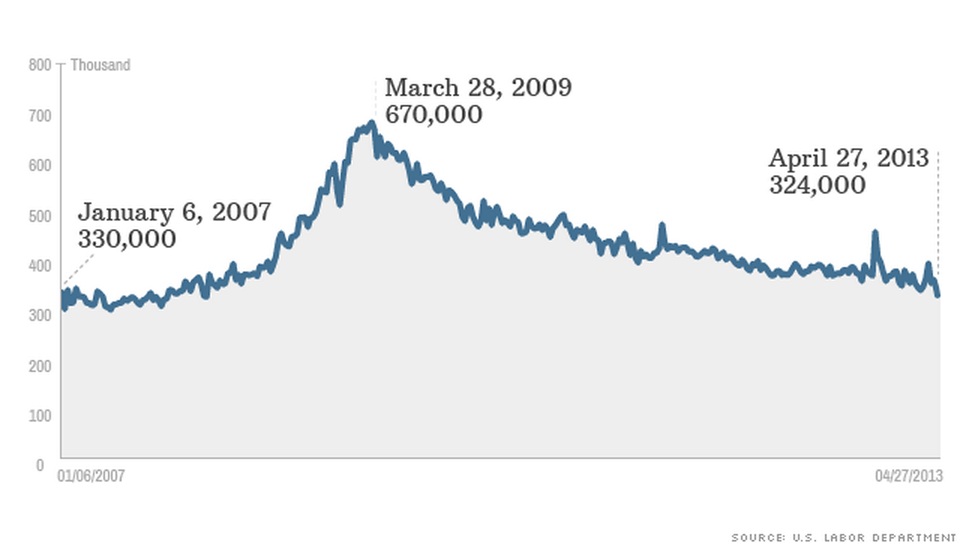

• Jobless claims lowest since January 2008 (MarketWatch)

• Deflation, not inflation, could bedevil markets (USA Today)

• The studies behind austerity are weak. The study behind ‘uncertainty’ is worse. (Wonkblog)

• Gold Bull Run Seen Over as Bear Drop Frays Faithful (Bloomberg)

• Facebook’s Results in Four Charts (WSJ)

• Too-Big-to-Fail Takes Another Body Blow (Rolling Stone) see also Bill to shrink banks won’t pass — but may help (USA Today)

• Europe Bans Pesticides Thought Harmful to Bees (NYT)

• Daniel Kahneman’s Gripe With Behavioral Economics (The Daily Beast)

• One Last Cringe for ‘The Office’ Finale (NYT)

What are you reading

Jobless claims fall to 5-year low

Source: CNNMoney

What's been said:

Discussions found on the web: