My morning reads:

• Tips From Wall Street Hedge Fund Gurus Fail to Reward Faithful (FT.com)

• Jobless Claims in U.S. Unexpectedly Fall to Five-Year Low (Bloomberg)

• Earnings Not Yet a Viral Sensation (WSJ)

• Stock Markets Rise, but Half of Americans Don’t Benefit (Economix) but see Everyone Who Started Watching ‘Mad Money’ In 2005 Now Billionaires (The Onion)

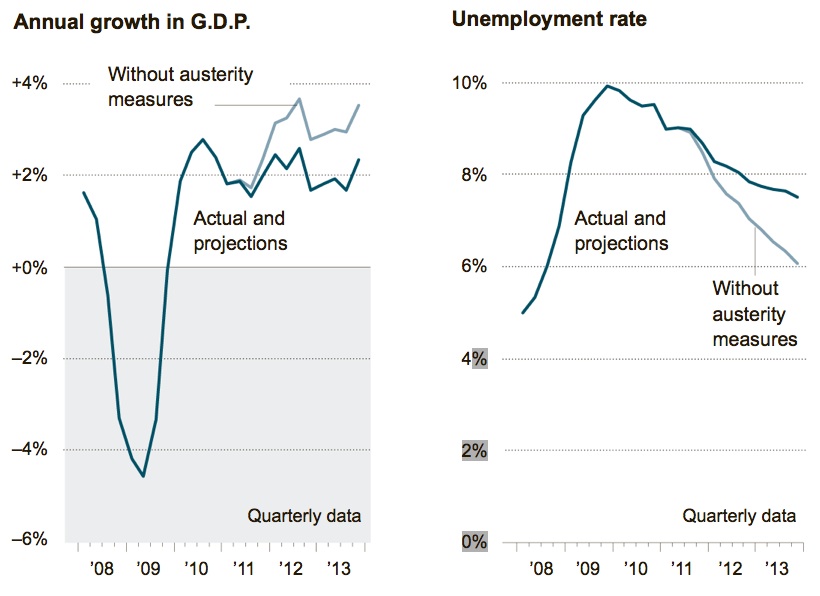

• Economists See Deficit Emphasis as Impeding Recovery (NYT)

• Are ‘Hot Hands’ in Sports a Real Thing? (NYT)

• What is wrong (and right) in economics? (Dani Rodriks Weblog) see also Rethinking macroeconomic policy (VOX)

• China’s Next Leap Forward: From Comrades to Consumers (Diplomat)

• Elizabeth Warren: Give students the same deal as big banks (Politico)

• 7 Dodgy Food Practices Banned in Europe But Just Fine Here (MotherJones)

What are you reading?

Fiscal Policies Take a Toll

Source: NYT

What's been said:

Discussions found on the web: