My morning reads:

• Japan’s mini crash: Blame China(FT Alphaville) see also Dumb money returns to Japan (ft.com)

• Extreme Fear (Joe Fahmy)

• Bernanke to Congress: I’m Not the Problem. You Are. (The Fiscal Times) see also Wonkbook: Bernanke lashes Congress (Wonkblog)

• Why Investors Fail (Motley Fool)

• Dudley Says Decision on Taper Will Require 3-4 Months (Bloomberg)

• Investing in Gold: Does It Stack Up? (Knowledge at Wharton)

• Teens are tired of Facebook ‘drama,’ find refuge on Twitter and elsewhere, says Pew (The Verge) see also Teens, Social Media, and Privacy (Pew Internet)

• Six Facts Lost in the IRS Scandal (ProPublica)

• Putting Apple in an Xbox (WSJ) see also The race to a “smart” television is over. Xbox won (pandodaily)

• Inside Google’s Secret Lab (Businessweek)

What are you reading?

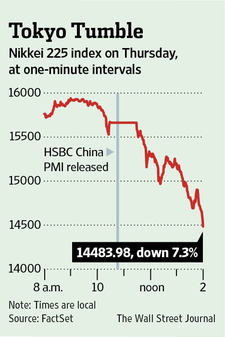

Japanese Stocks Fall 7.3% Overnight

Source: WSJ

What's been said:

Discussions found on the web: