My afternoon train reads:

• UH OH Dr. Doom: Buy stocks while you still can (CNNMoney)

• Deflation, not inflation, could bedevil markets (USA Today) see also Top Investors Will Feel Heat of New Epoch (Bloomberg)

• Bloomberg 2-fer: Things are looking up:

…..-American Auto Industry Has Best Performance in 20 Years (Bloomberg)

…..-Americans Most Upbeat in Five Years as Firings Slow (Bloomberg)

• Contra: Is Dr Copper, telling us the party’s over? (FT Alphaville)

• Blue Chip Stocks Fetch Ridiculous Valuations, But Don’t Sell Just Because It’s May (Forbes) see also The Myth of the ‘Spring Swoon’ (WSJ)

• We should stop expecting monetary policy alone to save the US economy (Quartz)

• Gold Bull Run Seen Over as Bear Drop Frays Faithful (Bloomberg)

• Banking groups split on ‘too big to fail’ (Politico) see also This Is How Wall Street Is Fighting the Brown-Vitter Bill (NY Magazine)

• Polls Plummet For Senators Who Voted No On Gun Background Checks (Talking Points Memo)

• 10 Classic Failed Tech Predictions (Above the Market)

What are you reading?

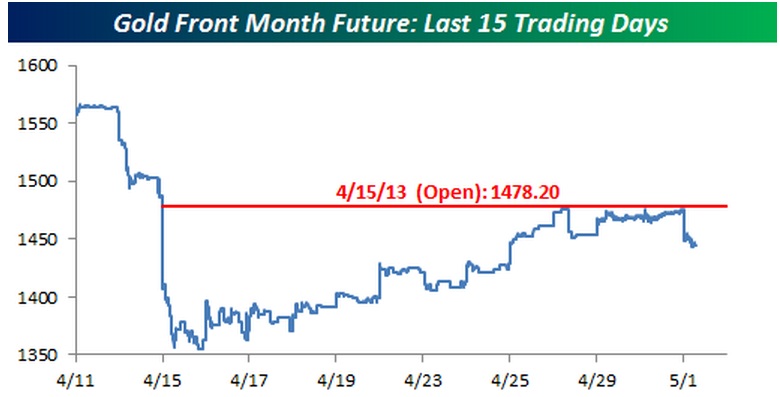

Gold Rally Stopped Dead In its Tracks

Source: Bespoke

What's been said:

Discussions found on the web: