My morning reads:

• Just How Good is Warren Buffett Anyway? (The Reformed Broker) see also Wrap Up: The Berkshire Hathaway Annual Meeting, 2013 Edition (Jeff Matthews Is Not Making This Up)

• Rewarding CEOs for Share Buybacks (Crossing Wall Street)

• What the Danish negative rate experience tells us (FT Alphaville)

• Cheap ‘Junk’ Leads to Expensive Mistakes (Moneybeat)

• Less Is More: Rogue Economists Champion Prosperity without Growth (Spiegel)

• Most data isn’t “big,” and businesses are wasting money pretending it is (Quartz)

• Conservative leaders slam Heritage for shoddy immmigration study (Washington Post)

• If you get a PhD, get an economics PhD (Noahpinion)

• Disruptions: New Motto for Silicon Valley: First Security, Then Innovation (NYT)

• Jony Ive is not a Graphic Designer (stratechery)

What are you reading?

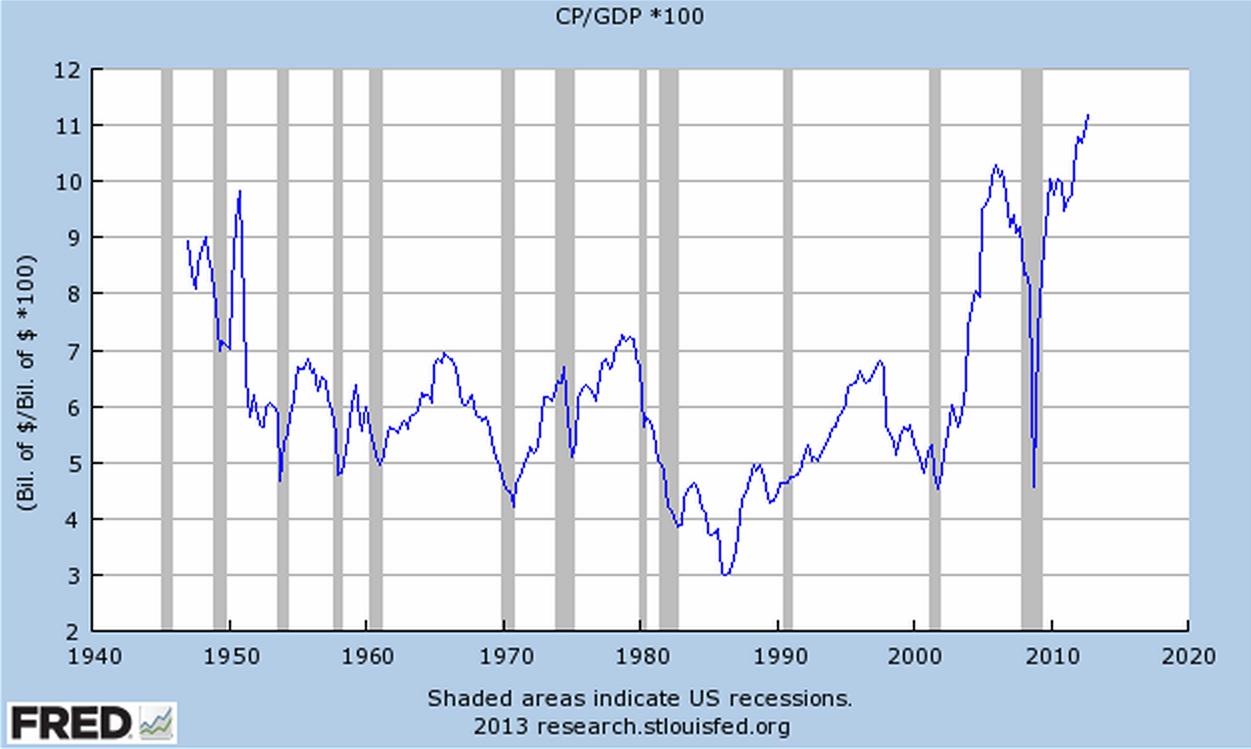

Corporate Profits as a Share of GDP

Source: Economist’s View

What's been said:

Discussions found on the web: