My morning reads:

• Kudlow: Has Bernanke Gotten the Story Right? (National Review)

• Are Market Valuations too High? (Turnkey Analyst) see also Equity Risk Premiums (ERP) and Stocks: Bullish or Bearish Indicator (Musings on Markets)

• As rich gain optimism, lawmakers lose economic urgency (Washington Post)

• Japan’s New Optimism Has Name: Abenomics (NYT) see also Fed Will Fuel Dollar Rally With More Confidence (Moneybeat)

• On Whose Research is the Case for Austerity Mistakenly Based? (Jeff Frankels Blog)

• Wall Street’s Giants Try ‘Flow Monster’ Formula (WSJ)

• The One-Person Product (Marco) see also A better, brighter Flickr (flickr)

• How the IRS’s Nonprofit Division Got So Dysfunctional (ProPublica)

• How to buy happiness (Los Angeles Times)

• 2013 National Geographic Traveler Photo Contest (Atlantic)

What are you reading?

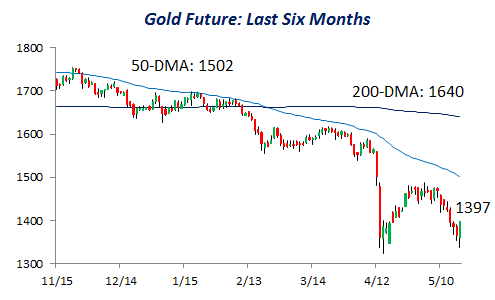

Gold Making a Double Bottom?

Source: Bespoke

What's been said:

Discussions found on the web: