My afternoon train reads:

• Seven Myths about Keynesian Economics (The Fiscal Times) see also Keynes’s Biggest Mistake (Economix)

• NYSE Margin Debt Raises Eyebrows (Moneybeat)

• Valuation: Forward P/E of the S&P 500 rising (Dr.Ed’s Blog)

• Is Soros shorting the dollar? (Sydney Morning Herald) see also The Cost of (Equity) Capital (Baseline Scenario)

• Reinhart-Rogoff’s Lesson for Economists (Bloomberg)

• The Apprentices of a Digital Age (NYT)

• Heritage vs. Heritage: Major Immigration Report Released Today Directly Contradicts Its 2006 Study (Think Progress)

• Nate Silver: Confidence Kills Predictions (Farnam Street)

• Easing Brain Fatigue With a Walk in the Park (NYT)

• Thank You for Not Sharing (WSJ)

What are you reading?

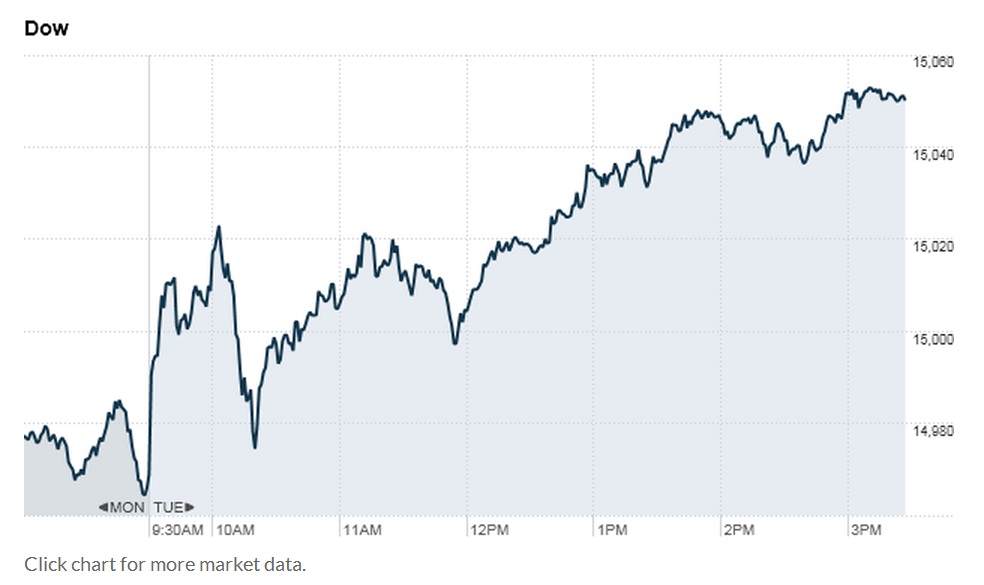

Dow closes above 15,000 for 1st Time

Source: CNNMoney

What's been said:

Discussions found on the web: