My afternoon traffic court reads:

• Markets and Memory Banks: Why Investors Can’t Imagine a Collapse of the Bond Market (Total Return)

• This Time It’s Different, Really (Money Beat)

• Don’t just do something, sit there! In Soccer and Investing, Bias Is Toward Action (Bucks)

• How the Case for Austerity Has Crumbled (New York Review of Books)

• One British Hedge Funds Secret? Cutting its fees! (DealBook)

• These financial advisers needed advisers (MarketWatch)

• Boring, Diversified, And (Still) Tough To Beat (Capital Spectator)

• IRS Was Wrong to Single Out Tea Parties, But Many Political Groups Should Not be Tax-Exempt (TaxVox) see also Congress WTF? Put Pressure on IRS to Investigate Conservative Tax-Exempt Groups (Atlantic)

• 29 Rules for College Graduates (WSJ)

• Photographer camped in -37C temperatures for three months to capture the Northern Lights over Rocky Mountains (Daily Mail)

What are you reading?

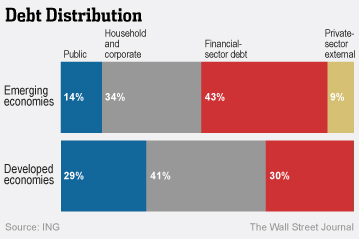

Debt Distribution

Source: WSJ

What's been said:

Discussions found on the web: