My morning reads:

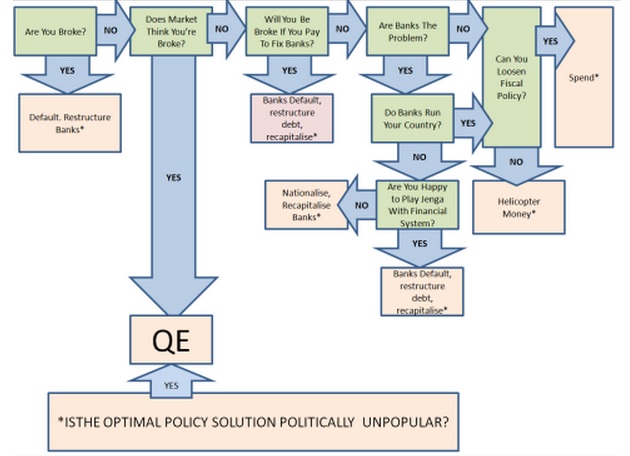

• Best headline of the day: QE: Because Nobody’s Got Any Better Ideas (It’s Not That Simple)

• Treasury yields go up a bit (FT Alphaville)

• The New ‘New Paradigm’ for Equities (Moneybeat) see also Stocks Change Their Fuel (WSJ)

• The Heavy Toll Of Investment Fees (Rick Ferri)

• Don’t Believe New Housing Bubble Hype (Developments)

• Volcker’s Aim: Responsive Government (NYT)

• “Can Japan Export Its Way to Recovery?” (Econbrowser) see also Japan’s Bond Market Wants BOJ to Purchase More Short-Term (Bloomberg)

• Is There Really a “Conservative Reform” Movement in Policy? (Next New Deal)

• Hugh MacLeod – digital disrupter (diginomica)

• new favorite tumblr: Screen Shots of Despair (Tumblr)

What are you reading?

QE: Because Nobody’s Got Any Better Ideas

Source: It’s Not That Simple

What's been said:

Discussions found on the web: