“In 1752, Prime Minister Henry Pelham converted the entire outstanding stock of British debt into consolidated annuities that would become known as consols. The consols paid interest on an annual basis just like regular bonds, but with no requirement that the government ever redeem them by repaying the face value.”

Today we look at the Consol, an 18th century debt issuance. Indeed, it is one of the earliest known debt issuances in recorded history.

Originally called consolidated annuities, the Consol is one of the earliest forms of government bonds. Primitive compared to the modern day 10 year bond, it had no maturity, and paid a coupon in perpetuity. It requires an act of the British Parliament to redeem them (likely not gonna happen with rates this low).

Originally issued with a coupon rate of 3.5%, the rates have been lowered throughout the 1800’s. In fact, it wasn’t until 1903 under the terms of the National Debt Conversion Act of 1888 that they lowered it to where it stands today at 2.5% (Parliament can redeem the debt at par).

They still trade today, but represent a tiny fraction of the UK’s total debt. Since 1958, the Brits moved to a traditional 10yr bond as their flagship debt instrument. Consol’s currently have a 200 basis point spread from the UK 10yr and trade at around 4.4%, paying a coupon four times a year.

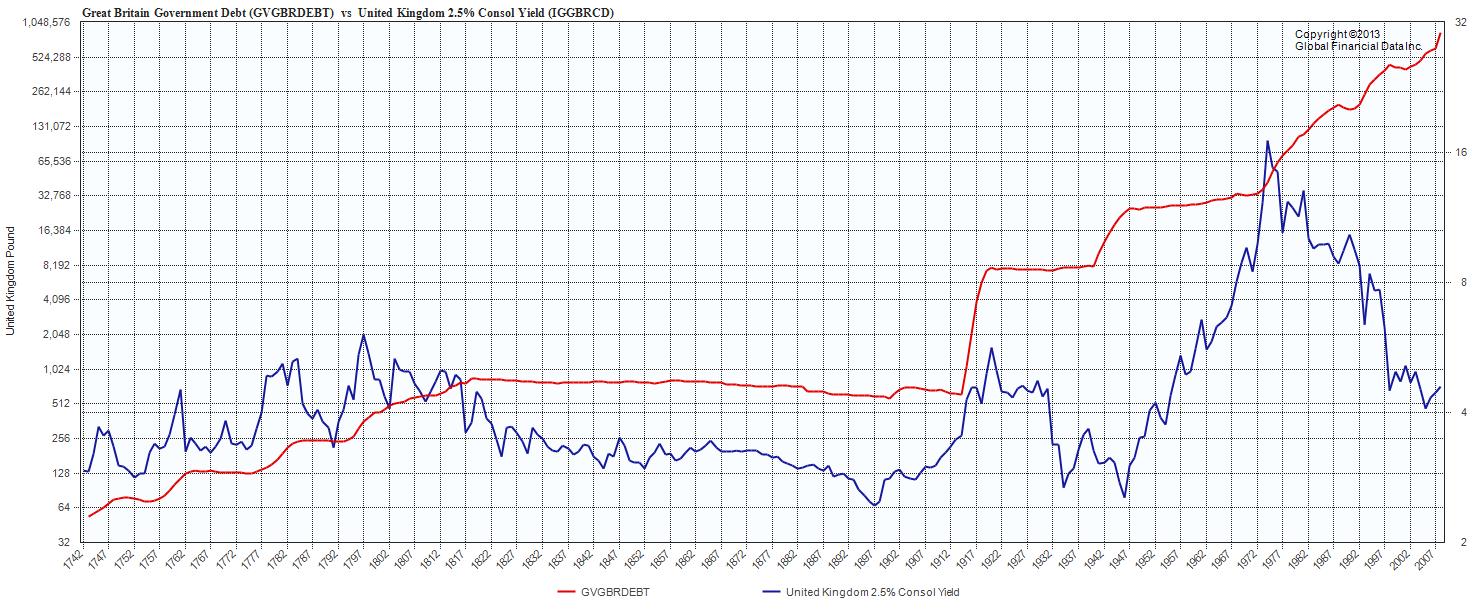

UK 2.5% Consol Yield vs the Great Britain Governmental Debt to 1742

click for ginormous chart

Source: Global Financial Data

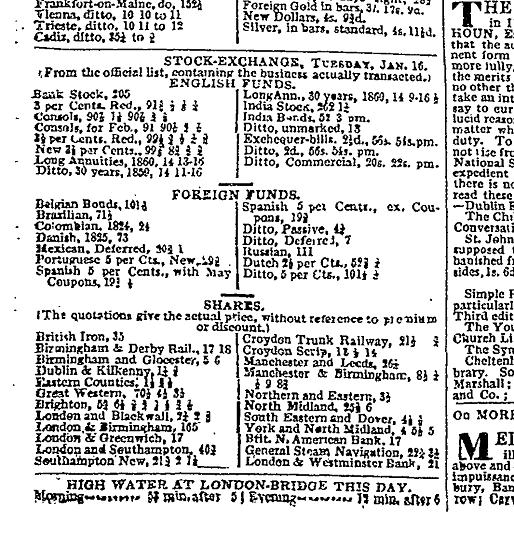

Here is a snapshot from the newspaper reporting the financial data on the Consol’s, original source, circa 1838:

Thanks to Ralph Dillon of Global Financial Data for charts.

Source:

Ralph Dillon

Global Financial Data, May 20, 2013

http://www.globalfinancialdata.com/

rdillon@globalfinancialdata.com

What's been said:

Discussions found on the web: