Click to enlarge

Source: NYT

Unbelievable chutzpah:

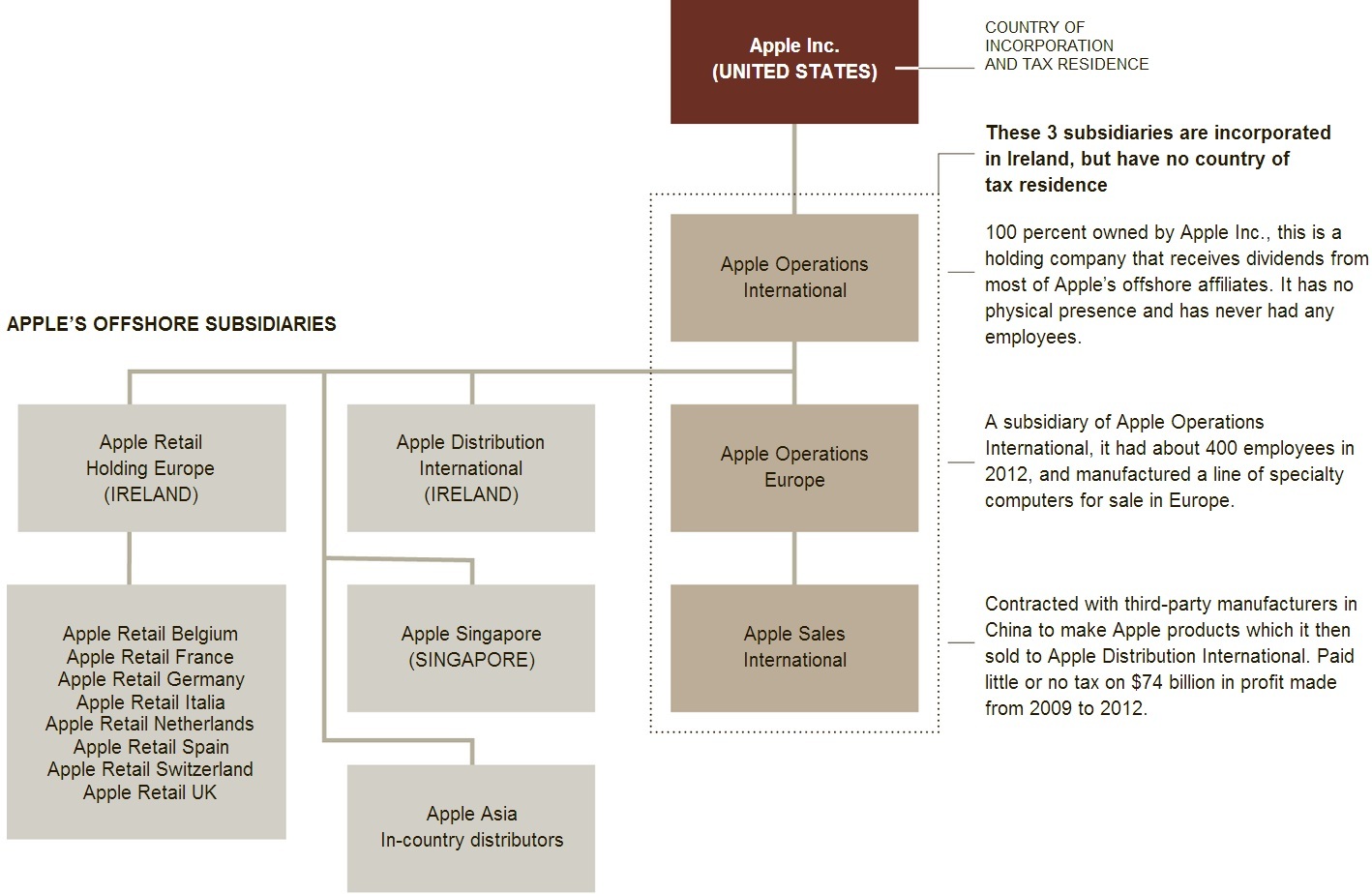

“Thanks to what lawmakers called “gimmicks” and “schemes,” Apple was able to largely sidestep taxes on tens of billions of dollars it earned outside the United States in recent years. Last year, international operations accounted for 61 percent of Apple’s total revenue.

Investigators have not accused Apple of breaking any laws and the company is hardly the only American multinational to face scrutiny for using complex corporate structures and tax havens to sidestep taxes. In recent months, revelations from European authorities about the tax avoidance strategies used by Google, Starbucks and Amazon have all stirred public anger and spurred several European governments, as well as the Organization for Economic Cooperation and Development, a Paris-based research organization for the world’s richest countries, to discuss measures to close the loopholes.

Still, the findings about Apple were remarkable both for the enormous amount of money involved and the audaciousness of the company’s assertion that its subsidiaries are beyond the reach of any taxing authority.

“There is a technical term economists like to use for behavior like this,” said Edward Kleinbard, a law professor at the University of Southern California in Los Angeles and a former staff director at the Congressional Joint Committee on Taxation. “Unbelievable chutzpah.”

Source:

Apple’s Web of Tax Shelters Saved It Billions, Panel Finds

NELSON D. SCHWARTZ and CHARLES DUHIGG

NYT, May 20, 2013

http://www.nytimes.com/2013/05/21/business/apple-avoided-billions-in-taxes-congressional-panel-says.html

What's been said:

Discussions found on the web: