Source: Gallup

Some key data points:

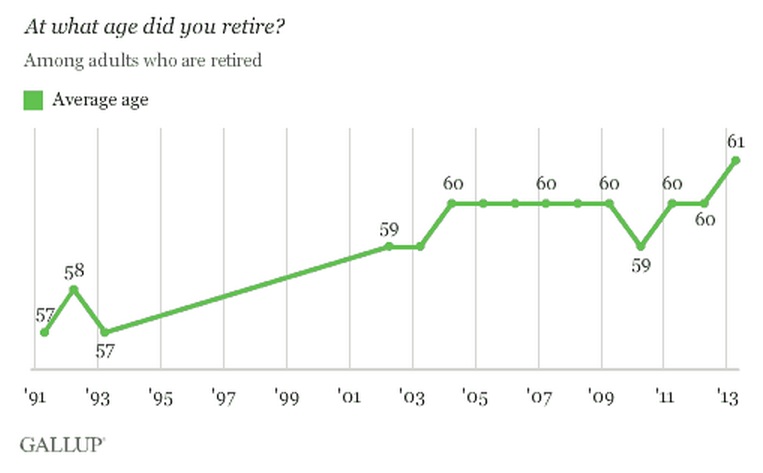

• The average retirement age has crept up by four years over the past two decades, from 57 in 1991 to the current 61

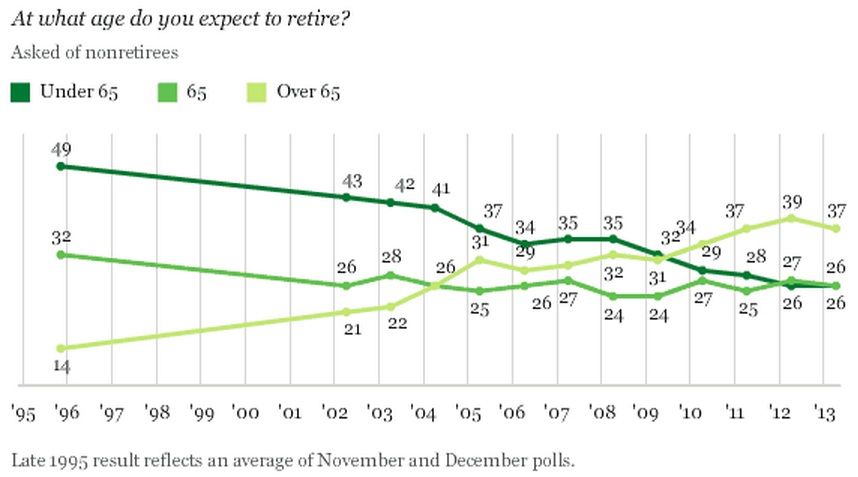

• The average nonretired American currently expects to retire at age 66, up from 60 in 1995.

• More than half of nonretirees aged 58 to 64 expect to retire after age 65, compared with 36% of nonretirees aged 50 to 57, 38% of those between 30 and 49, and just 26% of those younger than 30.

• The average age that current U.S. retirees said they retired is now 61, compared with 59 in 2003 and 57 in 1993.

• Gallup has found that Americans aged 60 to 69 who work have slightly better emotional health than those who do not work, and this relationship is stronger for Americans in fair or poor health.

What's been said:

Discussions found on the web: