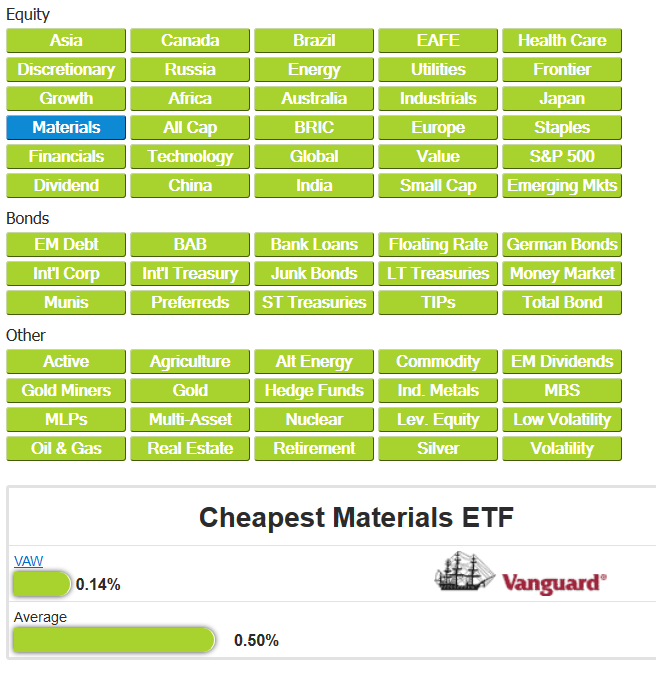

Very cool tool from ETF Database that allows you to select the least expensive way to express nearly any sector or style investment, with both lowest internal expense ratio and the median cost in that particular space.

(Let me know if they missed any and I will inform ETF Database of the omission)

Cheapest ETF for Every Investment Objective

click for interactive site

Hat tip Josh

What's been said:

Discussions found on the web: