Fewer U.S. shares are available to purchase, which is driving prices higher.

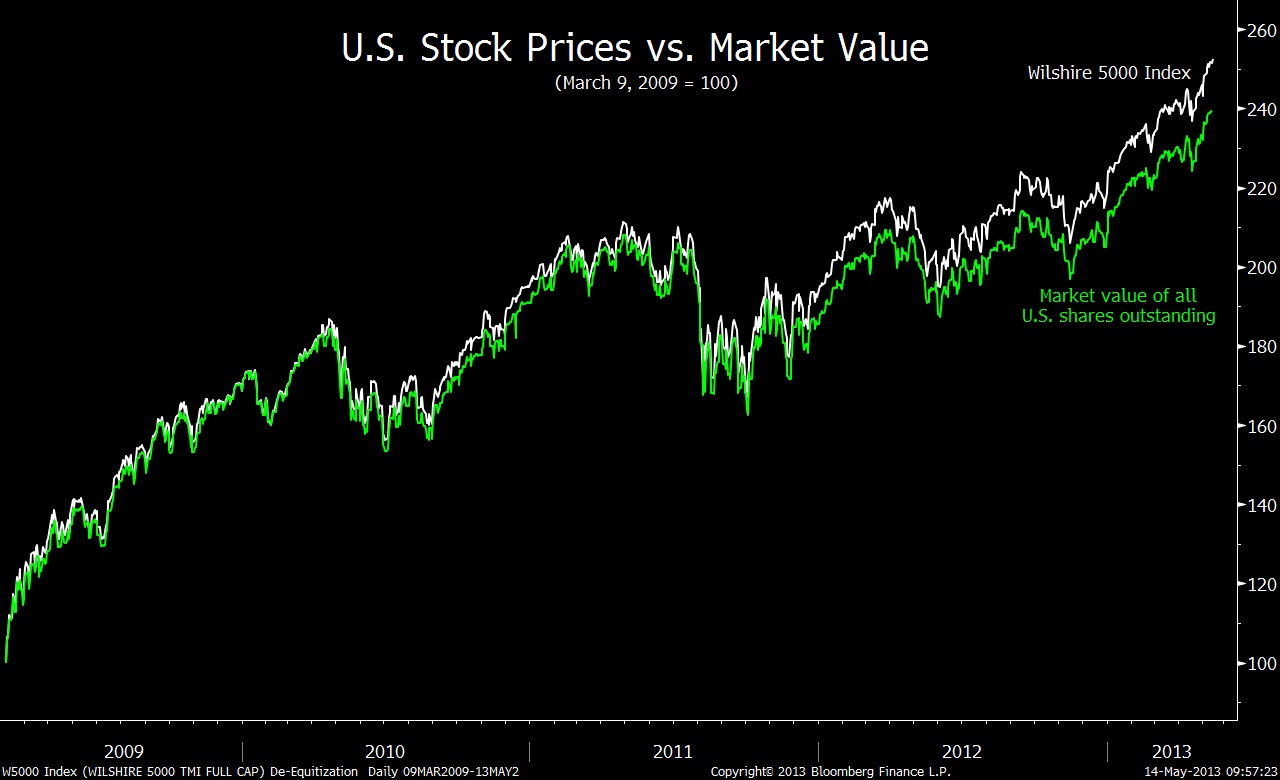

Repurchases are magnifying gains in U.S. stocks, and are poised to lift prices further, as seen in the Wilshire 5000 Total Market Index. According to Bloomberg, it has risen “more than the market value of all U.S. companies since the current bull market started in March 2009. The gap was about 13 percentage points.”

“The difference comes from a reduction in the number of shares. The resulting de-equitization is giving a boost to this stock-market rally,” wrote Pierre Lapointe, head of global strategy and research at the Montreal-based Pavilion Global Markets.

The S&P 500 now has 2.3% fewer shares than it did in July 2011, when share total reached its high for the bull market. The drop in total stock outstanding accounted for 25% of the past year’s earnings-per-share growth for companies in the index.

Source:

David Wilson

Bloomberg, May 14, 2013

What's been said:

Discussions found on the web: