In our day job, we have a Fiduciary relationship with our clients. A Fiduciary has a legal obligation where all actions are performed for the benefit of the client. It is a much higher duty of care than the typical “Suitability” standard, which essentially says you cannot sell Facebook IPO shares to Grandma. We sit on the same side of the table as our investors, as opposed to adversaries looking to “monetize” clients.

So you can imagine our amusement when the prospectus for this fund made its way to our attention yesterday:

Goldman Sachs Multi-Manager Alternatives Fund (GMAMX)

It is a mutual fund of hedge funds, with all the layers of fees costs and taxes you might imagine.

According to a prospectus, the fund gives investors “exposure to common trading strategies of hedge funds including:

The managers of the fund have already selected a number of hedge funds — Ares Capital Management, Brigade Capital Management, GAM International Management, Karsch Capital Management and Lateef Investment Management as the initial run of hedgie managers.

No surprise here: All of the “Costs to execute those strategies will be borne by the fund’s investors.” These costs include management fees, plus the use of leverage, derivatives and (up to 15%) illiquid investments. (Sounds awesome).

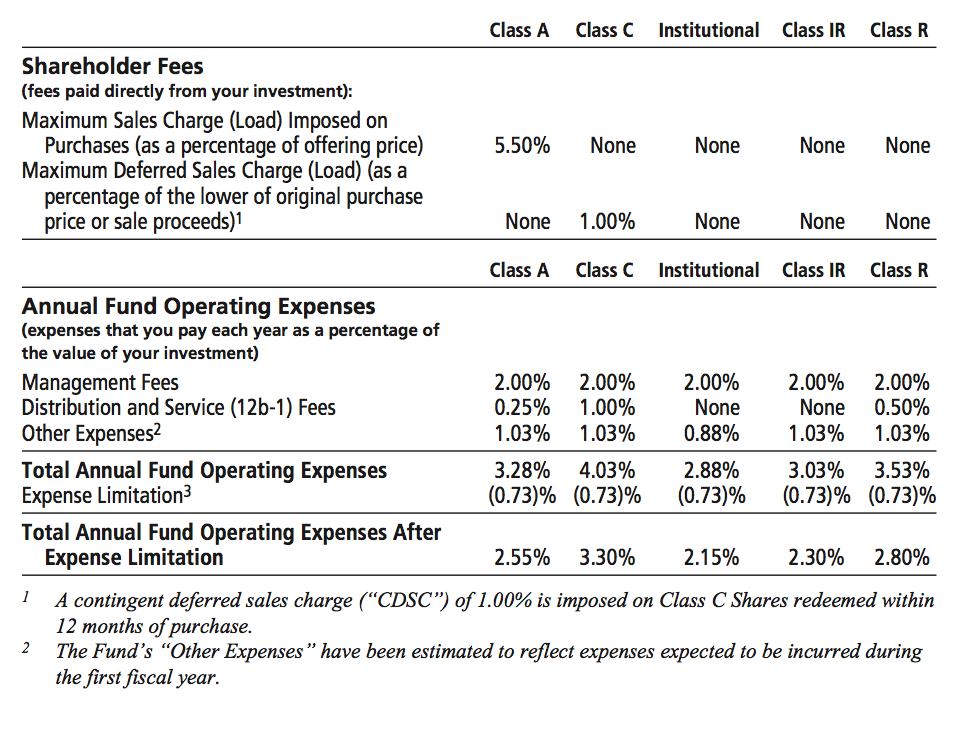

Annual fees for the fund may reach as high at 3.3% for some classes of shares — not counting the A shares, which start off with a 5.5% upfront fee.

Source: Fund Pospectus

You only need $1,000 to get into this Goldman fund (Yay!). Why you would want to is another question entirely. In addition to the enormous drag high fees impose, there is the performance issue. As TheStreet.com noted, “According to the HFRX Global Hedge Fund Index, hedge funds returned just 3.5% in 2012, significantly underperforming a 16% gain posted by the S&P 500 Index. Over five years, the hedge fund index has lost about 13.6%, while the S&P gained 8.6%, as of year-end 2012.”

As Fiduciaries, we are always seeking ways to reduce cost and risk for clients’ without compromising performance. That means making sure that muppet investments like this will not be finding its way into any of our portfolios . . .

~~~

Prospectus, Factsheet, and more details on etc, can be found at GSAM

What's been said:

Discussions found on the web: