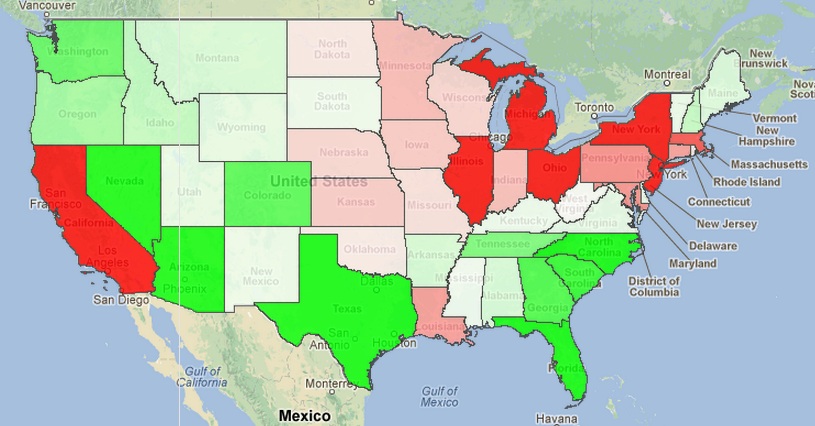

Fascinating interactive maps at How Money Walks shows where the tax flows int he United States are — both nationally from State to State and Intra-State from County to County.

Click for interactive experience

Source: How Money Walks

Source: How Money Walks

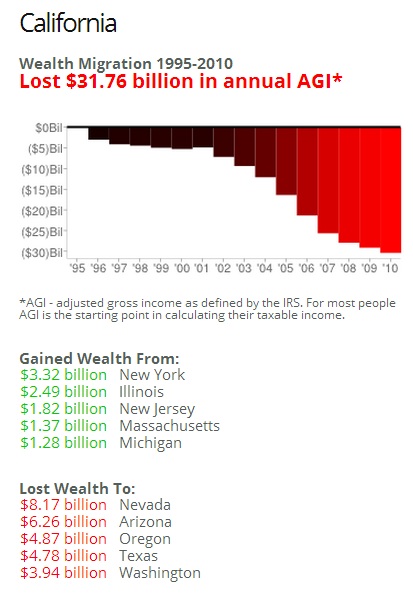

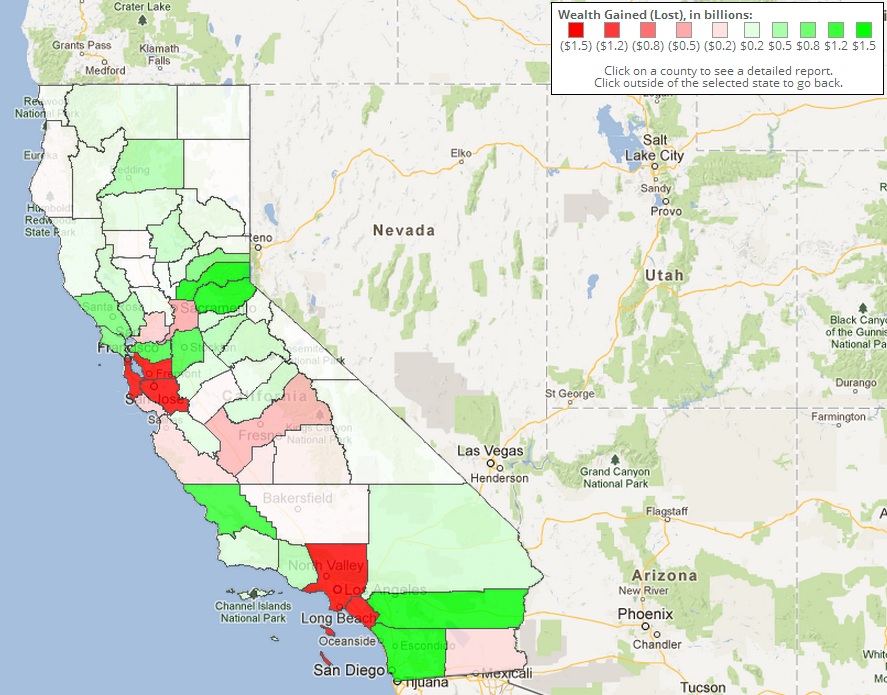

Since I am on the Left Coast, let’s use California as a sample:

Here is how cash migrated to and from other states:

You can see any inflow or outflow of any state, as well as the intra-state movement.

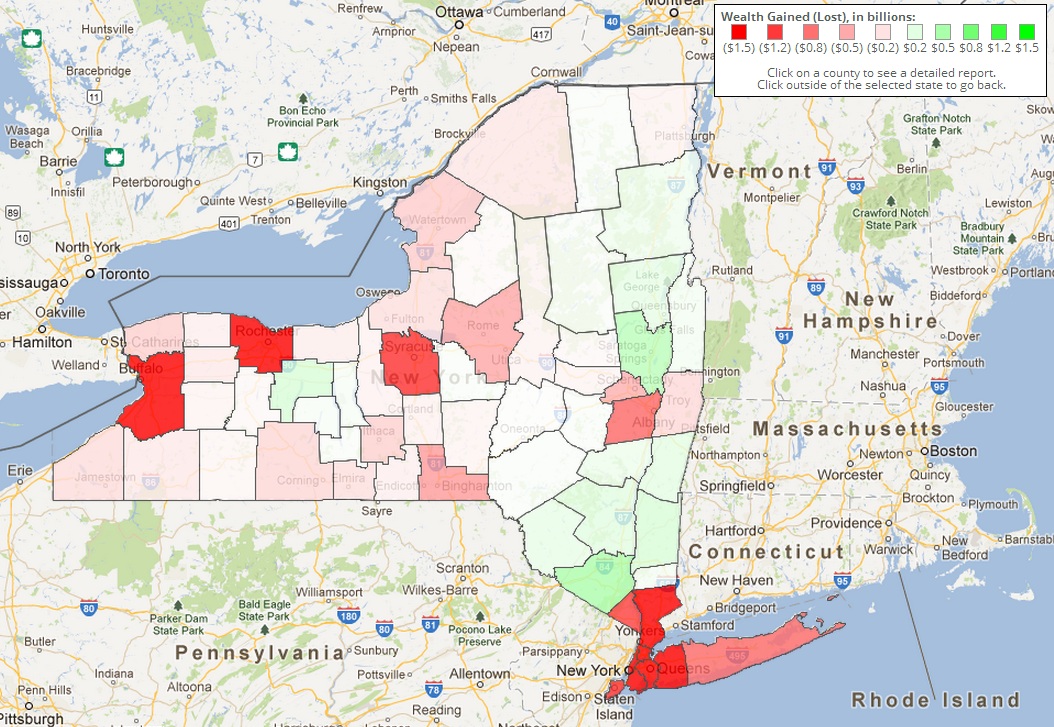

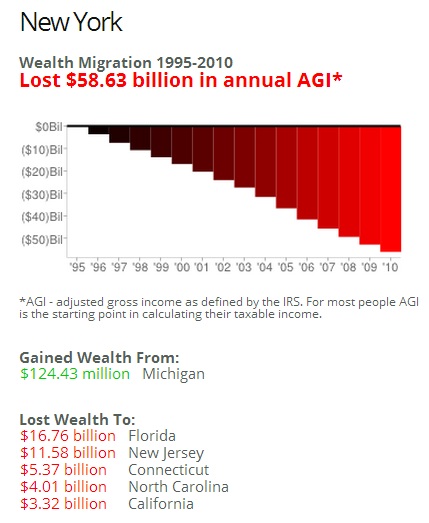

New York after the jump

Source: How Money Walks

What's been said:

Discussions found on the web: