Source: Real Time Economics

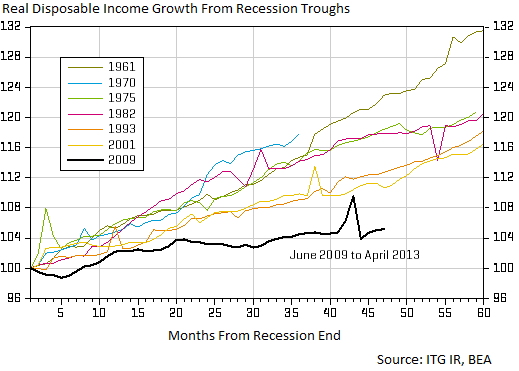

As the chart above shows, this is not an especially impressive recovery in terms of Real Disposable Income.

As we have discussed, this is not your typical post-recession recovery — it is a post credit-crisis recovery, and thats why metrics such as GDP, Job creation, wages and even inflation remain sub-par.

(Not that this has anything to do with the equity markets!)

What's been said:

Discussions found on the web: