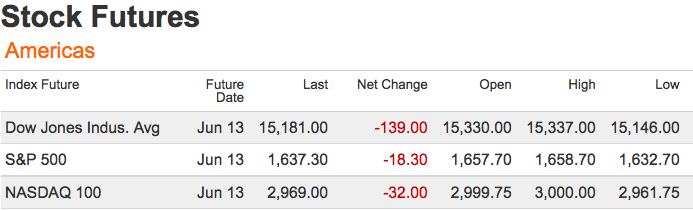

US futures are down following yesterday’s intra-day reversal after the FOMC minutes were released.

Nikkei is down 7.3%. Japan’s Topix index tumbled the most since the aftermath of the March 2011 tsunami and nuclear disaster. This follows a 50% rally in the Japanese market on Abenomics. Hong Kong Hang Seng Index is down 2.54%.

Major European indices are off 2-3%. EuroStoxx down 2.3%; FTSE100 off 1.9%. Deutsche Borse got whacked for 2.7%, wqhile the CAC40 is hit for 2.3%.

Josh has more details here; World market updates here.

What's been said:

Discussions found on the web: