Originally: Look Out Below, Spiking Yield Edition

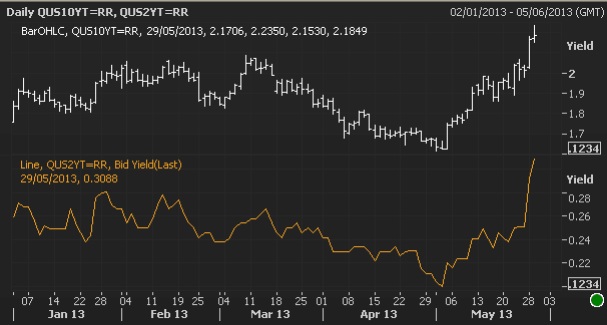

I am working on a longer piece today on how to invest after big rallies, but I had to address the increase in yields we are seeing this month:

10 Related Factors, Issues and Concerns Regarding Yield Increases

1) Large bond portfolios (think PIMCO, DoubleLine, etc). are getting out of the way in advance of Fed tapering. You can debate if they are early or not, but it is what it is.

2) Watch the impact this has on credit driven purchases: House (especially) but also Autos and CapEx.

3) The pop in home prices is more a function of constrained supply than excess demand. With by some estimates 43% of mortgaged properties either having low, none or negative equity, a big source of traditional buyers (and therefor sellers who put inventory into the RRE market) are missing

4) Given the big run in equities so far this year — up 16% before Q2 even ends — we should expect to see some corrective action. This suggests backfilling, shallow selloffs, lack of forward motion as gains get digested.

5) Is this the end of the cyclical bull that started in March 2009? Its too soon to tell. We continue to give the rally the benefit of the doubt, but we watch the internals for signs of significant breakdowns.

6) Eventually, higher yields are a competitor for stocks. (That’s not what the case is at 2% 10 year treasuries). However, upticks in borrowing costs will also affect corporate profitability — and that will impact not only earnings but the psychology underlying P/E multiple expansion.

7) Please use some context: Yields have moved up from the absurdly low level of 1.5% to 2% after a 30 year moved down from 17%. Some people will scream that “yields have skyrocketed 25%” (but these are the same folks who have been yelling POMO! POMO! POMO! for 146%). Its just as silly to claim that yields have retraced only 50 bips of the 1400 basis point move.

8) A better context is to note that yields have backed up 1/2 percent from the lows, and that will affect economic activity, earnings, and psychology in ways we may not fully recognize yet.

9) Yields go up for 3 reasons: a) Fed tightening, b) higher inflation, c) increased demand for capital.

10) That last point might be the most overlooked: Increased demand for capital. If that is what underlies this move upwards, than it would be a a positive sign for the economy and equities, and (surprisingly) not a negative one. We simply do not know which yet.

More on this later . . .

~~~

Note: Bloomberg Futures don’t seem to be updating so this morning we used CNN’s.

Treasuries exhibited some relatively sharp moves

Source: FT Alphaville

What's been said:

Discussions found on the web: