click for ginormous chart

Source: Kimble Charting

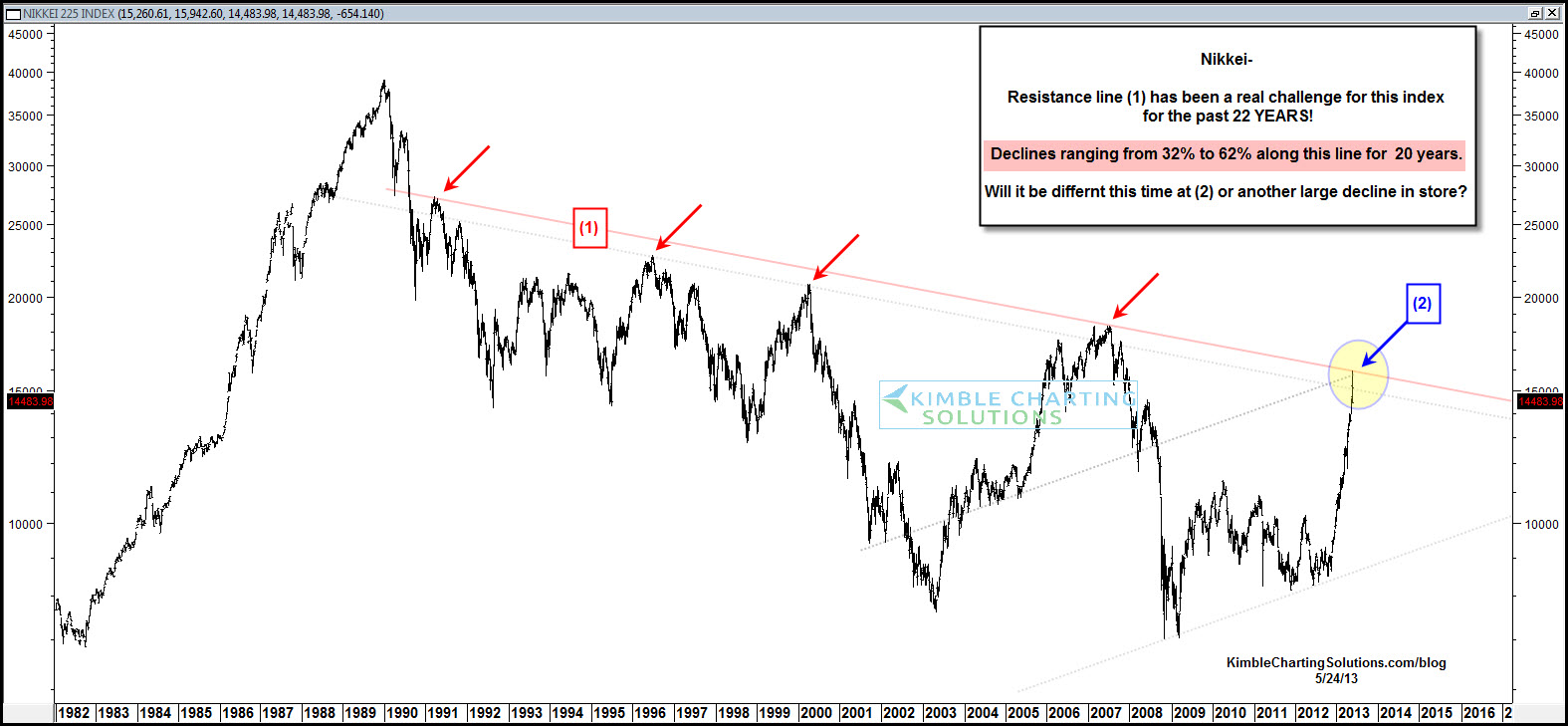

Awesome chart from Chris Kimble showing the Nikkei going back to 1982 — in particular, the downtrend that began in 1989 and still persists to this day.

Chris notes that Declines of 32% to 60% taken place at this level for the past 20 years!

One would normally expect a pullback and consolidation after a long move up to a major trendline, and under pre-Abenomics stimulus, that would be my highest probability outcome (pre-stimulus, I have no idea!).

The key here is if and when the Nikkei breaks through that trendline, it is likely the beginning of a longer term multi-year breakout. This is why we put on Japan exposure for clients much earlier this year.

~~~

Disclosure: Clients are long GAL, DXJ, which have substantial exposure to Japan.

What's been said:

Discussions found on the web: