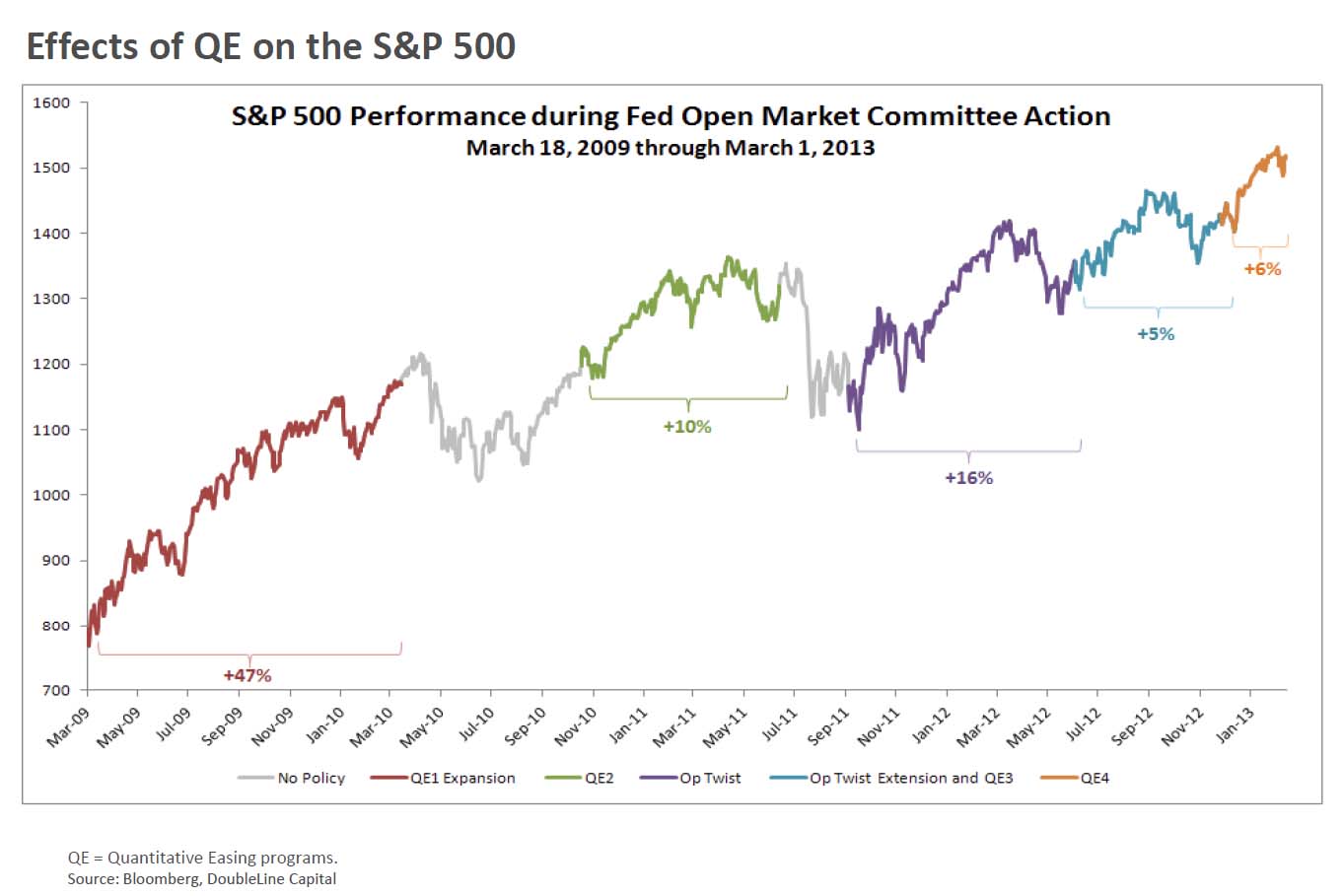

The chart above has been making the rounds ever since Jeff Gundlach showed it in his most recent quarterly update.

Call it a Rorschach test: It can be used to demonstrate pretty much whatever the author desires. I most commonly see it as “proof” that, but for the Fed’s QE program, this market would be flat or much worse. At the risk of creating a straw man, I find that a gross oversimplification, and one I would like to spill a few words discussing.

Let’s agree to a few simple factors surrounding the Fed’s market intervention: First, on the economy, there can be little doubt that the combination of Bond Buying (QE) and Zero Interest Rate Policy (ZIRP) is having a major impact on anything credit driven. Homes and Autos especially have seen higher volumes (Cars) and higher prices (Houses) than they would otherwise. This is a non-minor factor to both GDP and Job creation.

Next, there is a Fed component to positive earnings. The low cost of credit is not only encouraging consumers, it makes corporate financing much cheaper. Cheaper borrowing = lower costs. Hence, the Fed is contributing to record corporate profitability.

But as is stated so unequivocally in the chart title above, lots of folks seem to think QE is the prime, if not the only driver of equity markets. Here is where I depart company from many people who believe the Fed is the sole driver of markets. First is the standard single variable error we have lamented over the years. Next is the tendency to ignore the oscillating, reflexive nature of markets. Just as every sell off eventually becomes oversold, each rally eventually becomes overbought. George Soros made the case that there is a circular relationship between present market action and subsequent market reaction. A “bidirectional reflexive relationship” is how some have described this. Put more simply, it is inevitable that pullbacks occur after rallies. THAT IS HOW MARKETS PROGRESS.

Ignoring this to prove the impact of the Fed on markets is an admission of trading and market ignorance.

There is no doubt that the Fed is a large factor in our economy; the impact on both bond yields and risk assets is very significant. But to claim that markets are purely Fed driven is to misunderstand the basics of how equities function.

Please stop over-simplifying this . . .

Previously:

Single vs. Multiple Variable Analysis in Market Forecasts (May 4th, 2005)

Markets Are Rorschach Inkbot Tests (March 2nd, 2009)

What's been said:

Discussions found on the web: