Source: Bloomberg

from David Wilson of Bloomberg via the terminal:

Hedge funds are paying a price for being too hesitant to buy stocks in the midst of a four-year bull market, according to Barry Ritholtz, FusionIQ’s chief executive officer.

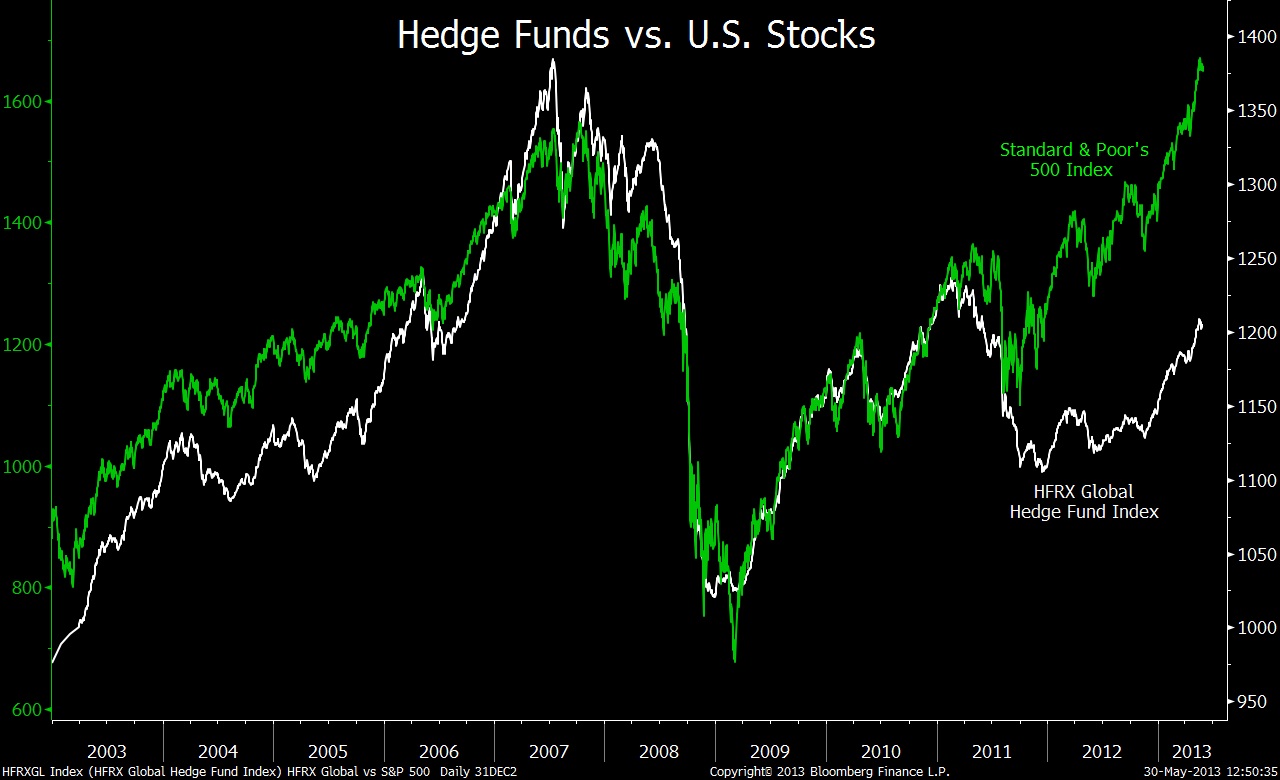

As the CHART OF THE DAY shows, Hedge Fund Research Inc.’s broadest fund index fell out of sync with the Standard & Poor’s

500 Index in 2011 and has yet to recover. The HFRX Global Hedge Fund Index had a 4.8 percent advance for the year through last week, while the S&P 500 was 16 percent higher.Many fund managers have been “overly timid and suffering from risk aversion” because of the magnitude of the losses that preceded the current advance, Ritholtz said yesterday during an interview. The S&P 500 tumbled 57 percent from its October 2007 high to its March 2009 low.

Federal Reserve policy has worked against managers with a macro strategy, which focuses on political and economic events, he said. The central bank is conducting its third round of bond purchases, or quantitative easing, and has held its benchmark interest rate near zero since December 2008.

“This has been an impossible macro environment to trade unless your macro theme has been Fed, Fed, Fed and you buy everything you can,” said Ritholtz, based in New York. He serves as his firm’s director of equity research.

The HFRX Macro/CTA Index was 0.2 percent higher for the year as of last week after falling for four years in a row. The indicator reflects the performance of macro funds and commodity trading advisers, which focus on buying and selling futures, options and other types of contracts.

Source:

David Wilson

Bloomberg, May 30, 2013

Update: Hey, its now at Bloomberg.com

What's been said:

Discussions found on the web: