My Sunday Reads:

• If You Only Know 5 Things About Investing, Make It These (Motley Fool)

• No, Bernanke hasn’t thrown grandma under the bus (MarketWatch) see also The Fed as a Fig Leaf (A Dash of Insight)

• CEOs are Terrible at Management, Study Finds (Forbes)

• America’s Broken Bridges (Businessweek) see also We’re Spending Fewer Federal Dollars On Infrastructure Than We Have In 20 Years (National Memo)

• Why only half of Americans gain from the stock market party (Fortune)

• Cash Piles Up as U.S. CEOs Play Safe With Slow-Growth Economy (Bloomberg)

• Apple’s Global Tax Shelter Days May Be Numbered (The Fiscal Times)

• Meet the Man Who Sold a Month-Old App to Dropbox for $100M (Wired) see also Why Waze Is Worth More Than $1 Billion (Atlantic Wire)

• 31 Charts That Will Restore Your Faith In Humanity (Business Insider)

• Star Trek Into Darkness: The Spoiler FAQ (io9)

What is for brunch today ?

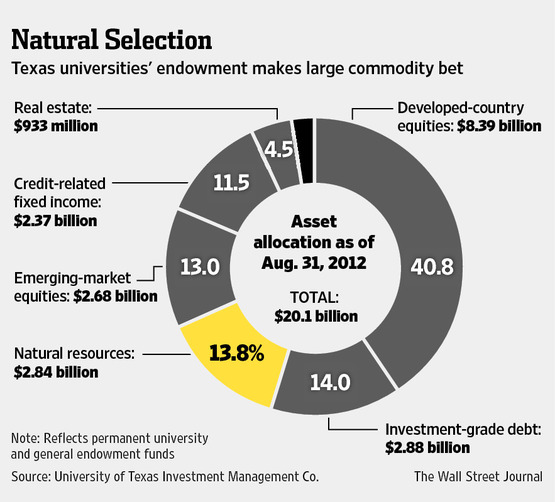

Gold U. Takes It on the Chin

Source: WSJ

What's been said:

Discussions found on the web: