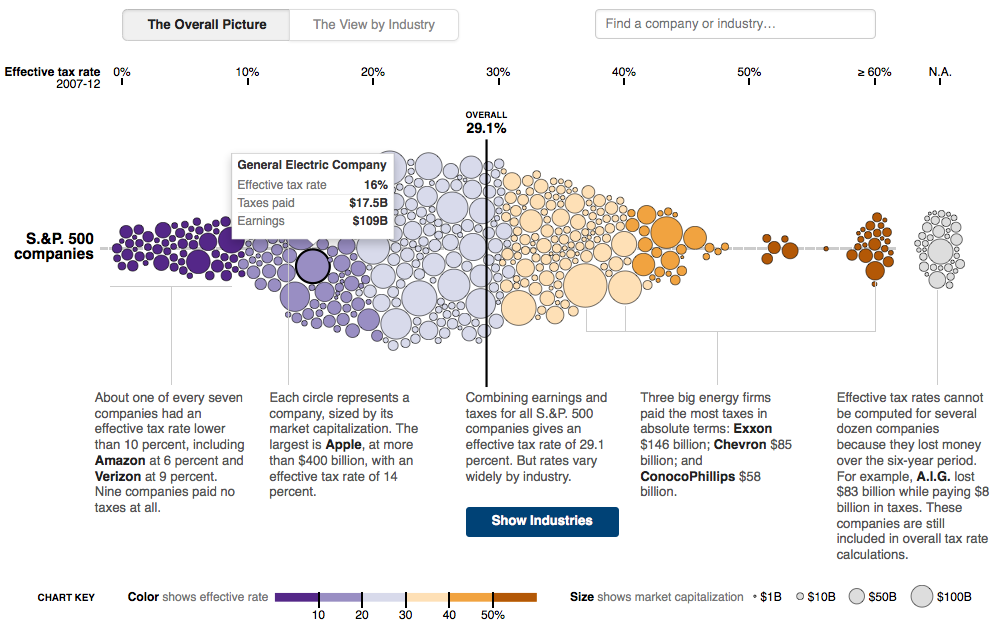

Cool interactive visualization that allows you to see how much various companies are paying in corporate taxes. You can hover over a circle to see what: each firm pays in taxes versus their total revenue & profits, plus the tax rate.

Or, break it down by industry, with a very cool animation showing the sector breakdown. Nice search function, too

Very neat.

Look at these firms also:

Carnival 1%

Ford 3%

Pepco: 3%

Amazon 6%

Boeing 7%

Valero 8%

Verizon 9%

Apple 14%

IBM 15%

Google 17%

Apple at 14% almost looks reasonable!

Source:

Who Will Crack the Code?

DAVID LEONHARDT

NYT, May 25, 2013

http://www.nytimes.com/2013/05/26/opinion/sunday/who-will-crack-the-code.html

What's been said:

Discussions found on the web: