Good Saturday morning! Here are some of the longer-form journalism that I have saved for your weekend reading pleasure.

• The dangerous combination of HFT+Twitter: Speed Kills (New Yorker)

• The Big Short War (Vanity Fair)

• Nate Silver: What Big Data can’t predict (Fortune) see also The Rise of Big Data How It’s Changing the Way We Think About the World (Foreign Affairs)

• Meet The Guy Who Helped Google Beat Apple’s Siri (Forbes)

• The Real Me: The internet’s unforgiving archive of our flaws (The Morning News)

• The Criminal Mind: The field of neurocriminology is revolutionizing our understanding of what drives “bad” behavior (WSJ)

• Top Secret: A hidden world, growing beyond control (Washington Post)

• Seeing Stars: The big science of building a giant telescope (Harvard Magazine)

• Octopus: The Footed Void (The New York Review of Books)

• The Uncensored Oral History of ‘The Hangover’ (Hollywood Reporter)

What is up on this glorious weekend?

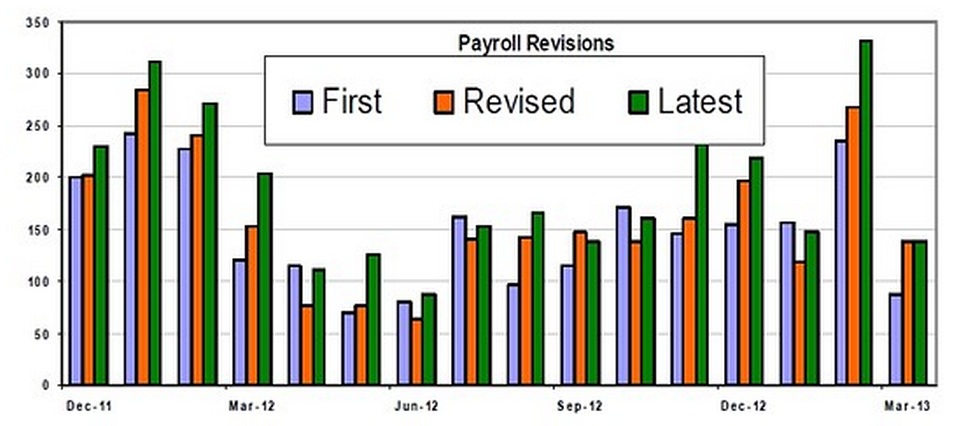

Job Growth Better Than You Think

Source: MoneyBeat

What's been said:

Discussions found on the web: