My longer form weekend reading material:

• How the Case for Austerity Has Crumbled (NYRB)

• The changing nature of work: Increasing automation is fundamentally shifting the nature of work away from ‘making stuff’ towards personal services. (piera)

• That’s a ‘Depression’: Europe’s Double-Dip Is Officially Longer Than Its Great Recession (Atlantic)

• This Is Your Brain, On: How our minds work their way through the maze of consciousness (BookForum

• Dirty medicine: Epic inside story of long-term criminal fraud at Ranbaxy (Fortune) see also Meet the career con man who made a fortune selling illegal pharmaceuticals online—and pulled off a federal sting that forced Google to pay $500 million. (Wired)

• Jaron Lanier: The Internet destroyed the middle class (Salon)

• Welcome to the Programmable World (Wired)

• The Possibilian: The mysteries of time and the brain. (The New Yorker)

• Secret Rocks: The $10 billion jewels industry is shrouded in beauty—and mystery. Is change about to come? (WSJ)

• The Dark and Starry Eyes of Ray Bradbury (The New Atlantis)

What’s up for the weekend?

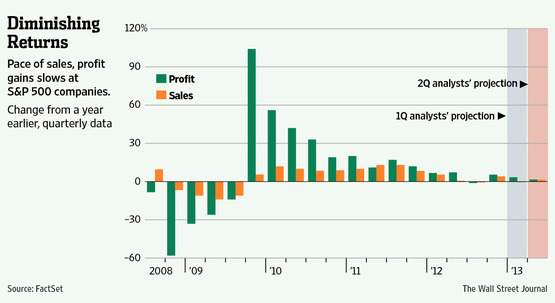

Tepid Profits, Roaring Stocks

Source: WSJ

What's been said:

Discussions found on the web: