My longer form 3 day weekend reading! Pull up a cup of coffee and get ready to have your mind expanded:

• Slaves to the algorithm: Our age elevates the precision-tooled power of the algorithm over flawed human judgment. This may not be such a good thing (aeon)

• Facebook, One Year Later: What Really Happened in the Biggest IPO Flop Ever (Atlantic)

• The Pseudo-Business of the NCAA (priceonomics)

• Mandelbrot Conceived the Mathematics of Roughness (New York Review of Books) see also Unknown Mathematician Proves Elusive Property of Prime Numbers (Wired)

• Left Behind: No break for the wounded America does a terrible job of caring for its war veterans (The Gazette)

• Philosopher Daniel Dennett: Seven Tools For Critical Thinking (Open Culture)

• Bret, Unbroken: His brain and body shattered in a horrible accident as a young boy, Bret Dunlap was mess. Then he discovered running. (Runner’s World)

• The Gut-Wrenching Science Behind the World’s Hottest Peppers (Smithsonian)

• End it like Beckham: England legend calls time on glittering career and retires (Daily Mail)

• Welcome to Google Island (Wired)

Whats up for your holiday weekend?

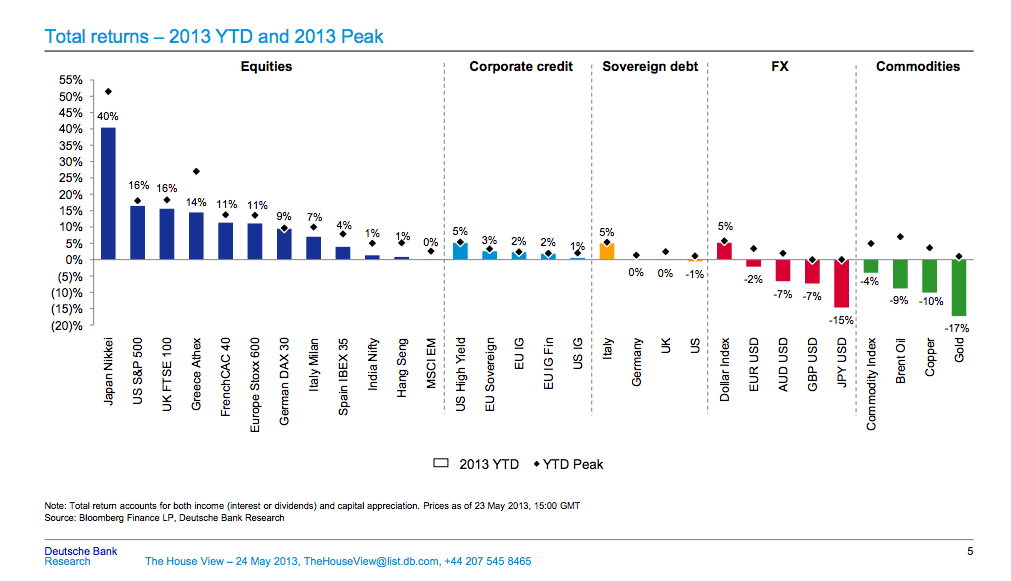

Year-to-date asset class returns

Source: Deutsche Bank via @matthewphilips via Abnormal Returns

What's been said:

Discussions found on the web: