During this past month, we have seen significant moves up and down. Volatility has risen; there have been some scary drops in Asia, and some follow through selling (more or less) in the US.

We have seen small measures of over-reaction, along the lines of “What do I do? What should I do? Should I do nothing, something, anything?”

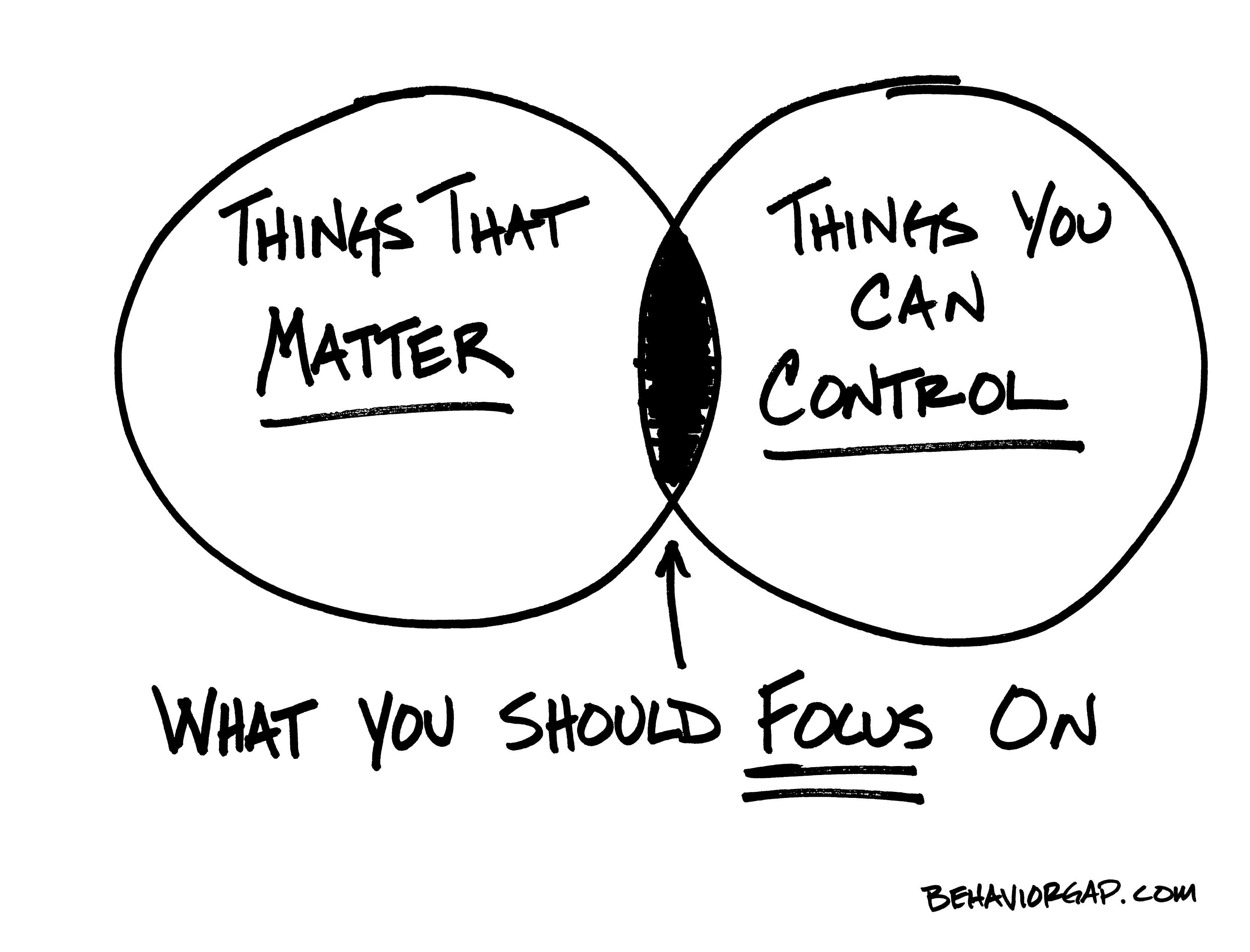

This is, IMHO, the wrong approach. During periods of market volatility and stress, I like to step back and consider (no pun intended) the big picture. I find it is helpful to understand what is within — and out of — my control.

Indeed, one of the most important things I have learned in my careers as a trader/strategist/investor was recognizing what is in my control and what is not in my control. My experience has been that when I focus on what is in my control and learn to roll with what it is out of my control, every thing else vastly improves.

Consider the following two lists of dozen items — these are what is in and out of your control:

Within My Control

1. Having a long term investing plan

2. Furthering my own education

3. What I watch (or don’t watch) on TV

4. Honoring my own buy & sell disciplines

5. Who I choose to associate with

6. Recognizing the importance of empirical evidence and data

7. The Portfolio Allocation I set up

8. Understanding my own emotions (and emotional state)

9. What I choose to read (and not read), as well as how much reading I do

10. How I structure my business, what I charge for my services, who I hire, etc.

11. Doing something professionally that is deeply satisfying

12. Maintaining my own ethical standards

What I write, say, and do are all obviously under my control as well.

The other list:

Out of My Control

1. What the Fed does

2. GDP

3. How my wetware works

4. Market action, rallies and sell offs

5. Interest Rates

6. Congressional Action

7. The Nature of Humans

8. Corporate Earnings

9. What the major media report on and make front page news

10. Unemployment Rates

11. How my brain is wired

12. Other people’s reactions, overreactions and panic

The conclusion is both obvious and simple: Focus on what you can control; do not stress over what you cannot control.

Investors and traders should endeavor to stay off of the emotional roller coaster, develop an intelligent long term plan, and then execute on that plan.

Previously:

Things I Don’t Care About (January 15th, 2013)

~~~

Update, May 30 2013 7:14pm

Carl sends this scribble along:

Source: Carl Richards, BehaviorGap.com

What's been said:

Discussions found on the web: