My morning reads:

• Separating Investment Advice From Financial Pornography (Huffington Post) see also Things Investors Should Read. Things Investors Should Avoid. (Motley Fool)

• More than $100 billion trapped in ‘zombie funds:’ industry data (Reuters)

• Just how bad is the EM sell-off? (FT Alphaville) see also Still got your money in emerging markets? Here’s what to worry about—and where (Quartz)

• When Bernanke Confounds, Wall Street Reaches for Theories (DealBook)

• The Properly-Formulated Bagehot Rule Has Four Parts (Brad DeLong)

• The Biggest Economic Mystery of 2013: What’s Up With Inflation? (Atlantic)

• The Food Lab: 7 Old Wives’ Tales About Cooking Steak That Need To Go Away (Serious Eats)

• Birthday Song’s Copyright Leads to a Lawsuit for the Ages (NYT)

• Waze Winners and Losers (Stratechery)

• This Is the End May Be the Greatest Stoner Movie Ever Made (io9)

What are you reading?

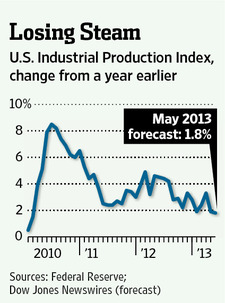

America Is Feeling a Bit Less Industrious

Source: WSJ

What's been said:

Discussions found on the web: