Good Friday morning:

• 7 charts that tell the Fed not to taper QE3 (MarketWatch)

• The Last Mystery of the Financial Crisis (Rolling Stone) see also Corrupted credit ratings, Standard & Poor’s lawsuit and the evidence (Vox)

• Like it or not, you too have exposure to emerging markets (Sober Look)

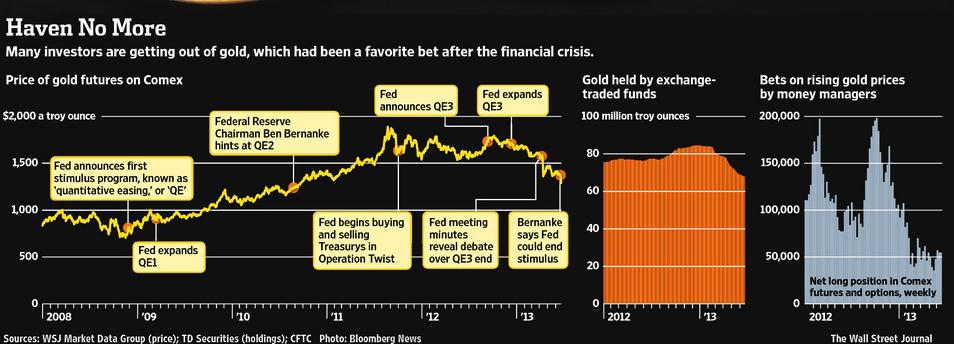

• Gold Trade Most Bearish Since ’10 as Fed Spurs Drop (Bloomberg) see also Gold Takes a Plunge Below $1,300 (WSJ)

• The Conflict Between Managing Funds and Selling Funds (Bronte Capital)

• Decline and fall: how American society unravelled (theguardian)

• WTF!?! Can Others See When You View Them on LinkedIn? (Full Contact) see also The Trouble With Kickstarter (WSJ)

• Finance blogger wisdom: summer reading (Abnormal Returns)

• BigBrain: An Ultrahigh-Resolution 3D Human Brain Model (Science Magazine) see also BigBrain: The Best Gray Matter Map Ever Made (Popular Mechanics)

• Advice on Life and Creative Integrity from Calvin and Hobbes Creator Bill Watterson (Brain Pickings)

What are you doing this glorious weekend?

Gold Takes a Plunge Below $1,300

Source: WSJ

What's been said:

Discussions found on the web: