My morning reads:

• What Happens When You Buy Assets Down 80%? (Mebane Faber)

• Gold Slips to 34-Month Low as Precious Metals Slide on Fed View (Bloomberg) see also Bottom Is Falling Out of Copper Prices (WSJ)

• Guru Networks Sell Social Investing to Copycat Traders (Bloomberg)

• Housing Market Shrugging Off Rise in Mortgage Rates (NYT) but see Run-up in mortgage rates raises questions about housing recovery (Los Angeles Times)

• Making a Case for Transparent Corporate Accounting Information (University of Berkeley)

• Stevenson and Wolfers on Happiness, Growth, and the Reinhart-Rogoff Controversy (Library of Economics and Liberty)

• When good intentions go wrong: Effects of bank deregulation and governance on risk taking (Vox)

• Airplane electronics bans: please return your fury to the ‘off’ position (theguardian)

• What is skeuomorphism? (Economist)

• Archimedes: Separating Myth From Science (NYT)

What are you reading?

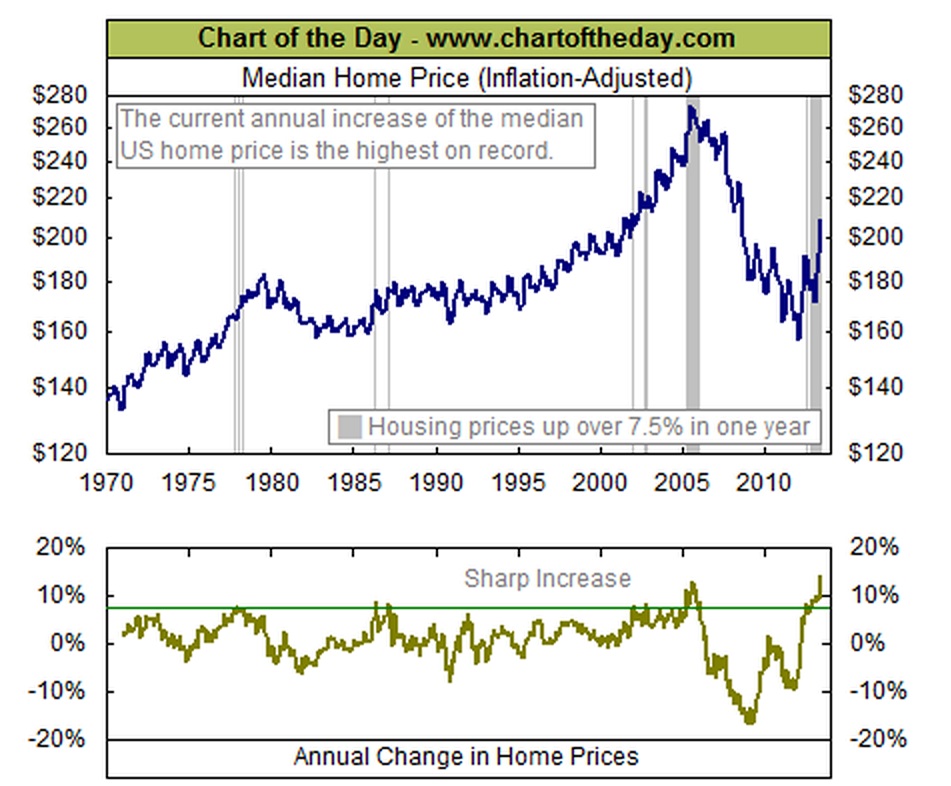

Chart of the Day

Source: Chart of the Day

What's been said:

Discussions found on the web: