My afternoon train reading:

• Watch What Fed Says, Not What It Does (Real Time Economics) see also Abe-Bernanke 1-2 Punch Pummeling World’s Top Carry Trade (Bloomberg)

• Are There Any Stock Values Left? (It turns out yes) (Morningstar)

• Google stock split closer to reality (CNNMoney)

• Analysis: The Myth of the US Housing Bubble (World Property Channel) see also Here Comes the Housing Inventory (Redfin)

• LinkedIn Builds Its Publishing Presence (NYT)

• What FDR Hated About Glass-Steagall (Echoes)

• Unnatural Disaster: How mortgage servicers are strong-arming the victims of the Moore, Oklahoma tornado (among others) (New Republic)

• Filmmaker picks a copyright fight with “Happy Birthday” (ArsTechnica)

• Your Hidden Censor: What Your Mind Will Not Let You See (Scientific American)

What are you reading?

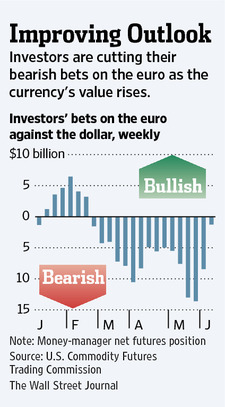

Euro Becomes the Port in a Storm

Source: WSJ

What's been said:

Discussions found on the web: