Good Sunday morning, here is a quick update of weekend news:

• When Interest Rates Rise, Stocks Don’t Have to Fall (NYT) see also Edgy About Interest Rates? Don’t Pop the Xanax Yet (Fiscal Times)

• Fleck: Cracks have appeared in the Japanese bond market, and potentially ours as well, as the world’s finances may be reaching critical stress-points (Washington Post)

• Donlan: Should Pot Be Legal? (Barron’s)

• The view from Europe: If companies can fire at will, they can also hire at will (Telelgraph)

• Washington ‘Spends’ More on Tax Breaks Than on Medicare, Defense, or Social Security (Atlantic)

• Labor union decline, not computerization, main cause of rising corporate profits (EurekAlert)

• Drones to enter public skies in 2015: Will it be safe? (Yahoo)

• Tokyo Prepares for a Once-in-200-Year Flood to Top Sandy (Bloomberg)

• Are We at the Electric Car’s Tipping Point? (Daily Beast)

• Behind the ‘Internet of Things’ Is Android—and It’s Everywhere (Businessweek)

What’s for brunch?

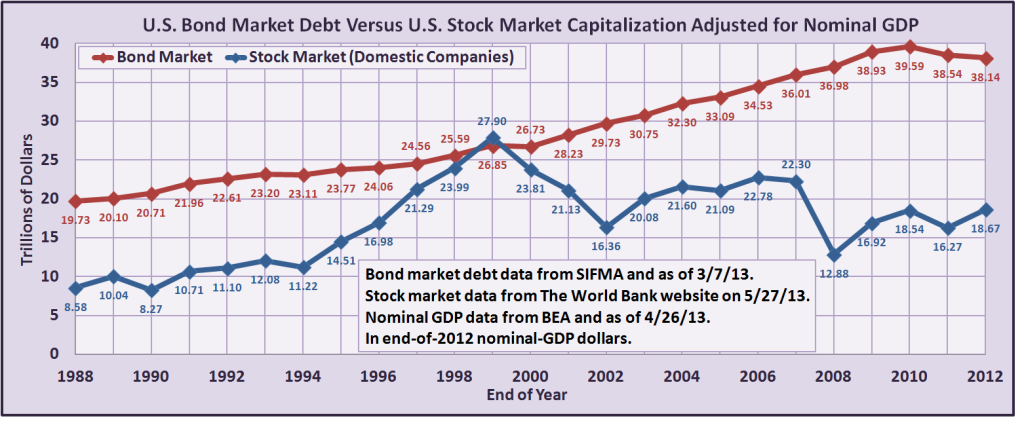

The U.S. Bond Market May Be Much Different Than You Think It Is

Source: Learn Bonds

What's been said:

Discussions found on the web: