My morning reads:

• Bond Funds: A Bond Market Plunge That Baffles the Experts (NYT) see also What’s Eating Munis? (WSJ)

• NFP: An outcome desired only by assholes (TRB)

• Useless extraction (The Research Puzzle) see also Money for Nothing (and Fund Losses for Free) (aiCIO)

• It’s A “0.6%” World: Who Owns What Of The $223 Trillion In Global Wealth (Zero Hedge)

• The Million-Dollar Illusion: Why Many Retirees Could Outlive a $1 Million Nest Egg (NYT) see also 140% Increase in Food Stamp Use Since 1990 (Real Time Economics)

• Wrestling with Reform: Financial Scandals and the Legislation They Inspired (SecHistorical)

• Shiller: Want to Fix Social Security? Use the Right Wrench (NYT)

• For Sussing Out Whether Debt Affects Future Growth, the Key is Carefully Taking into Account Past Growth (Supply Side Liberal)

• Did Hipster Tech Really Save the Obama Campaign? (Wired)

• Scalia Gives Obamacare a Big Boost (Bloomberg)

What’s for Brunch?

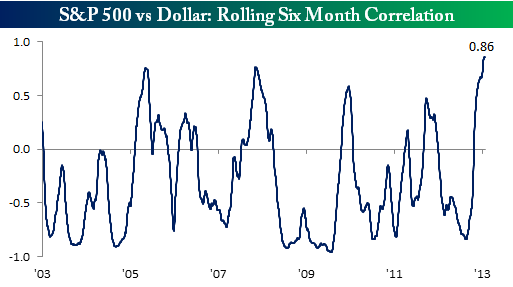

Dollar vs. Stock Correlation Hits Multi-Year Extreme

Source: Bespoke

What's been said:

Discussions found on the web: